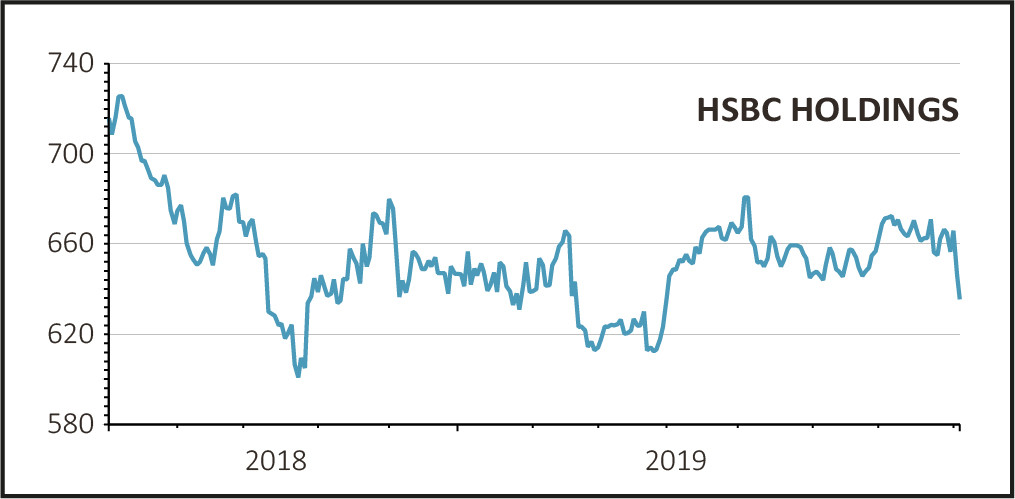

Shares in global lender HSBC (HSBA) fall 2% to 633p as the surprise exit of chief executive John Flint and the admission that its US business won’t meet its return targets next year offset a generally strong set of first half results and a $1bn share buy-back programme.

Flint, who has only been in the job for 18 months, is stepping down immediately. According to chairman Mark Tucker, ‘a change is needed to meet the challenges that we face’.

Due to an about-face in expectations for US interest rates, which are now seen falling rather than rising, and ‘revenue headwinds’ in its global banking and markets division, HSBC’s US operations are no longer expected to reach their 6% return on tangible equity target next year.

This news overshadows better than expected second-quarter revenues and earnings and a $1bn buy-back, albeit this is half the level of last year’s share repurchase.

READ MORE ABOUT HSBC HERE

Total revenues for the group increased by 7.6% in the first half to $29.37bn marking an acceleration compared with the 5% growth shown in the first quarter.

A strong performance by the retail banking and wealth management business and an $828m gain on the completion of the Saudi British Bank merger with Alawwal bank in Saudi Arabia helped lift pre-tax profits for the period by 15.8% to $12.4bn.

Due to an increase in interest on customer loans and financial investments, the net interest margin improved to 1.61% compared with 1.59% in the first quarter.

However this is still well below the level of rivals such as Barclays (BARC), which reported first half net interest margins of 3.18% on its UK business and 3.99% on its international business, and Lloyds (LLOY) which reported a group margin of 2.90%.

Also provisions for bad loans jumped to $1.14bn in the first half while the bank took another $615m of charges for ‘customer redress’ to settle PPI mis-selling. As with Lloyds, mis-selling claims are spiking in the run-up to the 31 August deadline rather than falling.

Meanwhile the sudden departure of the chief executive is seen as a sign that changes under his leadership weren’t regarded as deep enough to keep the bank ahead of increasingly complex and challenging markets.

There were frustrations in particular with the lack of improvement in its lagging US business.