Europe’s biggest bank by assets, HSBC (HSBA), believes rising interest rates are acting as a growth lever. The banking giant cites a rate rise as one important reason behind the robust performance of its retail banking division (its largest), which posted first quarter operating profits of $1.8bn.

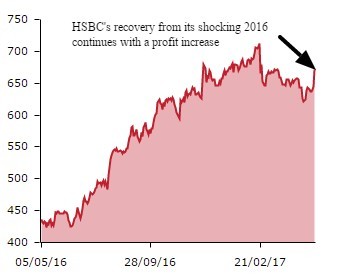

The global bank’s share price rose by more than 3% to 665.1p on Thursday 4 May. The bank beat market expectations with its adjusted pre-tax profit, coming in at $5.9bn which is a 12% improvement on the same time last year.

This will come as great news for investors still reeling from the banks horror show 2016 which saw a 62% year-on-year decline in profits.

However, its results were not all positive. HSBC’s overall revenue is down by 13% although management attributes that to the sale of its Brazilian business and adverse currency movements.

HSBC’s chief executive Stuart Gulliver says that the increase in adjusted profit was driven by a strong performance in its global banking and markets unit as well its retail banking and wealth management businesses. He adds that the bank completed its $1bn share buy-back last month, another move aimed at appeasing disgruntled investors.

Core strength

The business has also shored up its capital strength, its common tier one (CET1) capital rising to 14.3% from 13.6% in the final quarter of 2016. This represents a significant buffer to any financial downturn which could impact the sector.

The CET1 ratio measures the size of a bank’s capital against its assets. It takes into account the risk profile of customers’ loans.

Stock appeal

Investors seeking income may be attracted by HSBC's relatively safe dividend. The stock is currently offering a 6% payout yield based on this year's rough 40p per share dividend. That compares with Barclays' (BARC) 1.5% yield, the 5.6% on offer at Lloyds (LLOY), while Royal Bank of Scotland (RBS) has yet to return to the dividend list.