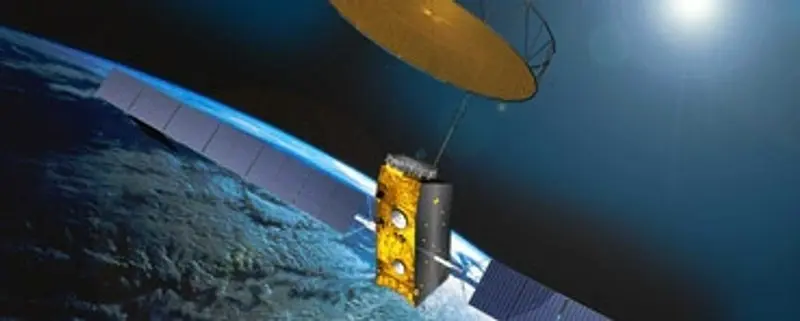

On Thursday evening Inmarsat's (ISAT) latest satellite blasted off, launched from Europe's space port in Kourou in French Guiana (watch the launch video). This is a massive bit of kit, Alphasat is the size of a double-decker bus, and it will join the UK communications group's dozen or more other satellites orbiting earth once several weeks of in-orbit testing are complete.

These launches are a big deal. Such highly engineered bits of communications kit cost millions of pounds to develop and build, so you can understand a little nervousness when you strap one to millions of gallons of highly explosive rocket fuel, then light the fuse. Which makes it equally understandable that investors marked the shares just that little bit higher this morning, up 8p to 708p, although they have come back to 701.5p this afternoon.

The question is, can the shares be expected to match Alphasat's soaring journey, or are they destined to stutter and splutter back below the £6 mark where they started the year. They've already had a bumpy ride in 2013, and the future looks overcast with stormy challenges. Back in May the FTSE 250 company plunged nearly 8% after posting adjusted earnings before interest, tax, depreciation and amortisation (ebitda) of $154.2 million (roughly £99.3 million) for the three months to end March, missing the $156.9 million expected by analysts and lower than the $157.7 million reported for the same period last year.

Casting a shadow over Inmarsat?s trading is the impact of US spending cuts, or the so-called sequestration, on its US government contracts. 'We have seen a sudden and pronounced deterioration in both demand and profitability, in each case principally related to US budget cuts,' chief executive Rupert Pearce spelled out at the time. Hopes that cost cuts can make up the difference look more science fiction than science fact.

Then earlier this month, a Russian Proton-M rocket crashed just after launch from the Baikonur Cosmodrome in Kazakhstan, the third failure linked to Proton rockets in the past year. The unmanned rocket was not carrying Inmarsat kit, but the UK group's flagship $1.2 billion Global Xpress (GX) trio of satellites are booked passengers for Proton rockets. The first GX satellite is due for launch in November, but that looks now likely to get bumped in to early 2014 as engineers unpick the wreckage of this recent blow. 'GX had already been partially delayed due to the two previous Proton failures as International Launch Services had to work through the backlog,' say analysts at broker Jefferies.

Such delays don't inspire hope that Inmarsat shares will rally much in the near-term. The majority of analyst share price targets hover somewhere around the 740p to 800p mark, suggesting perhaps 14% upside at best over the next 12 months, not exactly pulse-racing. Bears reckon the stock could crash all the way back to 560p, although Citigroup stands well apart from the crowd with its gloomy prediction. Half-year results are due soon (2 August), but there seems little reason to believe Inmarsat's near-term horizons are broadening, or that its shares have much fuel in the tank for now.