Holiday Inn-owner InterContinental Hotels (IHG) has blamed a late Easter for a second quarter slowdown in room revenues. The US is the hardest hit, with a 0.4% decline in revenue per available room (RevPAR) between April and 30 June), although the slowing theme showed up in Europe also.

US RevPAR in the first three months was 1.9%, so the deceleration is marked. Even more so considering the 80 basis points (0.8%) decline across the US hotels market, according to data from market researcher STR.

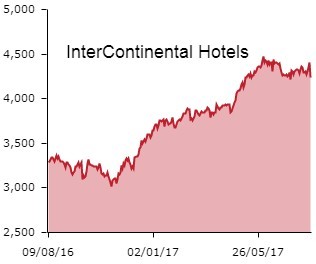

Shares in InterContinental are among the FTSE 100's biggest fallers on Tuesday, slumping around 4% to £42.37.

Overall for the six month period, InterContinental reported RevPAR up 2.1%, partly thanks to a 0.9% rise in occupancy.

Numis analyst Tim Barrett remains cautious despite pre-tax profit beat consensus expectations by 3% at $320m. His chief concerns seems to surround InterContinental's valuation premium versus global peers.

The analyst calculates that InterContinental is currently trading on a 2018 enterprise value to earnings before interest, tax, depreciation and amortisation (typically shortened to EV/EBITDA) of 14.3.

This compares to an EV/EBITDA of 14 for Marriott, Hilton on 12.4-times and Choice's 13.2 multiple.

Barratt says that, on the assumption InterContinental maintains anticipated growth, the hotel operator is on track for a 6% increase in earnings before interest and tax this year to $744m.

In the year to 31 December 2018, InterContinental trades on a forecast 21.6 times earnings per share.