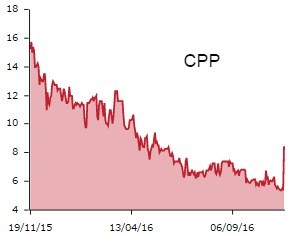

Perennial underperformer Card Protection Plan (CPP) has surprised investors with a big upgrade to profit expectations in the year to 31 December.

Shares gained as much as 64% to 8.87p today as cost control, higher sales volumes in India, as well as a weaker pound drove improved performance.

The company helps customers to cancel and replace lost cards using an emergency assistance service.

CPP has struggled since 2012 when it received fines and other penalties worth £33m from the Financial Services Authority (FSA) for mis-selling insurance products between January 2005 and March 2011.

According to the now defunct FSA, replaced by two separate financial services regulators, CPP sold a card protection product claiming to offer £100,000 worth of insurance cover, even though customers' cards were already covered by insurance from their banks.

CPP also exaggerated the risks and consequences of identity theft when selling its identity protection product, the regulator said.