Investors continue to pull money out of the markets, according to latest information. Trading statements from fund management firms Man Group (EMG), Miton (MGR) and Jupiter Fund Management (JUP) all show outflows from their core equity funds.

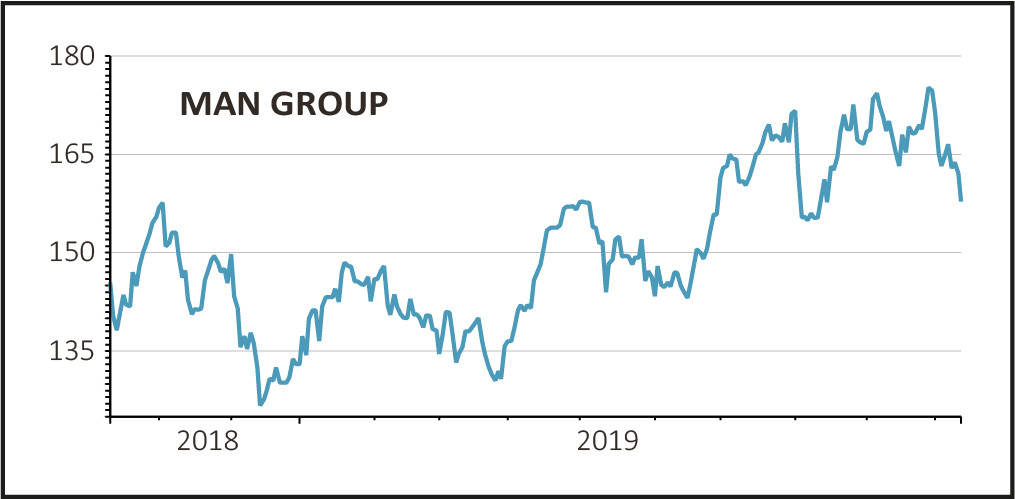

Man Group’s funds under management at the end of September were $112.7bn compared with $114.4bn in June due to net outflows of $1.1bn, a $1.1bn negative impact from foreign exchange movements and a positive investment contribution of $0.7bn.

According to chief executive Luke Ellis, the third quarter ‘saw a continuation of the trends experienced in the first half of the year with strong absolute performance and inflows into our quant alternative strategies, and outflows from our long only equity strategies’. Man shares slid 2.7% to 158p on the update.

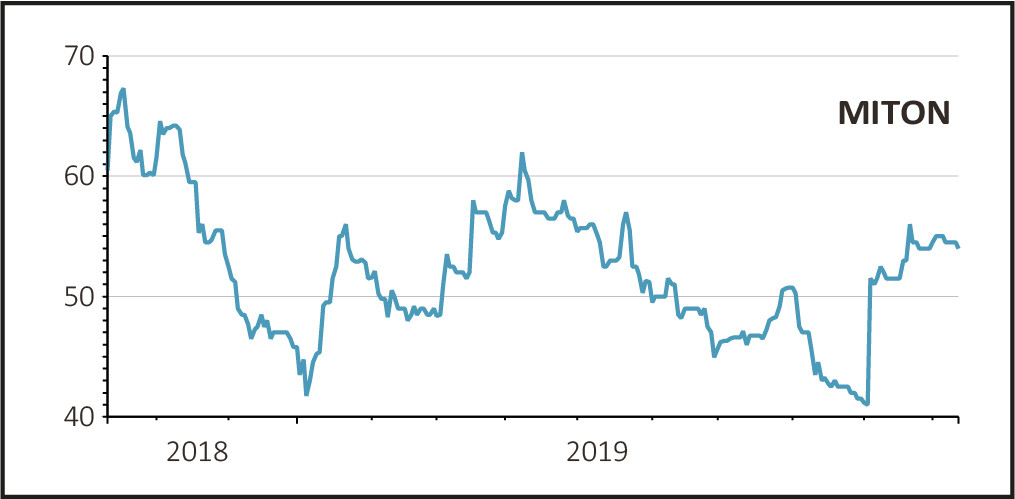

Miton’s assets under management at 30 September were up 7% compared with the start of the year at £4.68bn, thanks to a positive investment contribution of £427m, but net outflows were £121m compared with net inflows of £927m in the nine months to September last year.

After seeing inflows in the first quarter, Miton’s equity funds saw outflows in both the second and third quarters even though most of the uplift from investing came specifically from their equity holdings. Miton shares were flat after the update at 54.5p.

Jupiter’s assets under management were £45.1bn at the end of September compared with £45.9bn in June, as positive investment performance and foreign exchange movements of £496m were offset by outflows of £1.3bn.

The bulk of the outflows came from Jupiter’s mutual funds, including the flagship European Fund (B5STJW8) and the European Growth Fund following the surprise exit of star fund manager Alexander Darwall.

According to the firm, ‘net mutual fund outflows were £1.0bn during the quarter, of which £1.1bn outflows were from our European Growth strategy, principally within the UK and Continental Europe.’ Jupiter shares added 1.5% to 323p on the update.

Darwall will leave Jupiter in mid-November to launch his own asset management business, Devon Equity Fund Management. Responsibility for managing funds was handed over at the start of this month.

Meanwhile, segregated mandates also saw net outflows of £300m after two existing clients withdrew £700m of assets, offsetting inflows of £400m from new clients.