Shares in out-of-favour fashion brand Ted Baker (TED) rallied 13.4% to 950p on Monday following weekend reports that founder and former chief executive officer (CEO) Ray Kelvin is considering a private equity-backed buyout that would take the retailer private.

The enigmatic Kelvin resigned as CEO earlier this year following a company probe into ‘hugging’ claims made by some employees, an allegation he denies. According to The Mail on Sunday’s scoop, Kelvin has indicated he would support a buyout that would take Ted Baker private under the existing management team led by Lindsay Page.

Kelvin took a voluntary leave of absence from his role as CEO at the shirts, suits and fragrances designer in December after allegations of misconduct were made against him.

An internal independent committee has been investigating the claims and commissioned law firm Herbert Smith Freehills to look into the allegations and the company’s policies, procedures and handling of HR-related complaints.

READ MORE ABOUT TED BAKER HERE

Though he has denied all misconduct allegations, Kelvin agreed to resign as CEO and a director back in March but he owns about a third of the company and is the creative inspiration behind Ted Baker, which he founded as a single shirt specialist store in Glasgow over 30 years ago.

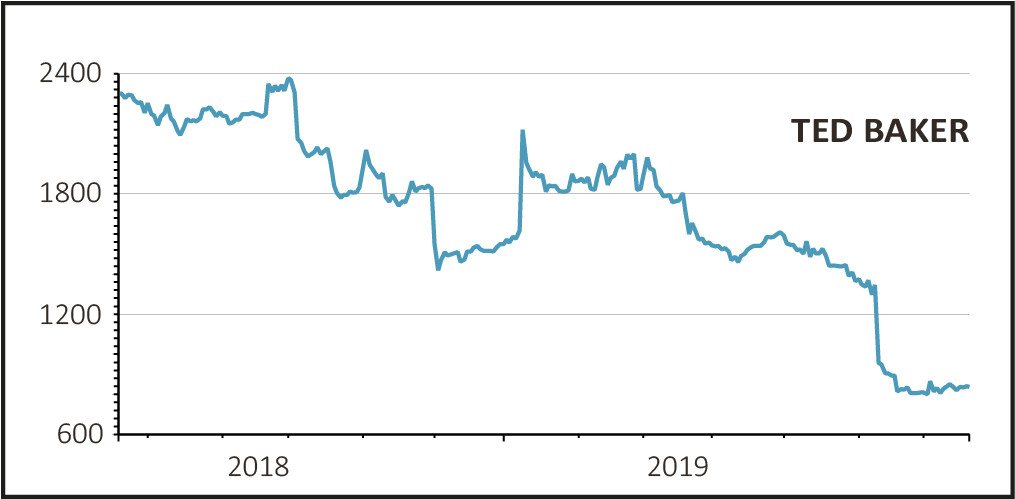

FIRMLY OUT OF FASHION

Shares in Ted Baker are firmly out of fashion with investors following a flurry of downgrades and damaging earnings alerts.

On 11 June, the quintessentially British clothing brand warned that profits for the year to next January would fall significantly short of forecasts amid margin pressure and consumer uncertainty in key markets, forcing it to materially downgrade earnings expectations and stoking speculation Ted Baker might be a takeover target.

This compounded the negative impact of an earlier profit warning coughed up in February, which Ted Baker blamed on currency fluctuations, higher costs and stock write-downs.