The market gives a hearty thumbs up to property web portal Zoopla’s (ZPLA) £160 million deal to buy Ulysses Enterprises - owner of price comparison site uSwitch. It is up 13.5% to 210p as the news takes the narrative around the stock on from the threat of increased competition from its new rival OnTheMarket.com.

This had pressured the shares in early 2015 with OnTheMarket’s January launch perceived as a significant competitive threat for the business. The estate agent led challenger had compelled its members to only advertise on one other site and it had appeared Rightmove (RMV) - not Zoopla - was the ‘other site’ being chosen. Though a trading update alongside today’s news ran somewhat counter to this analysis with traffic up 11% year-on-year and mobile visits rising 34%.

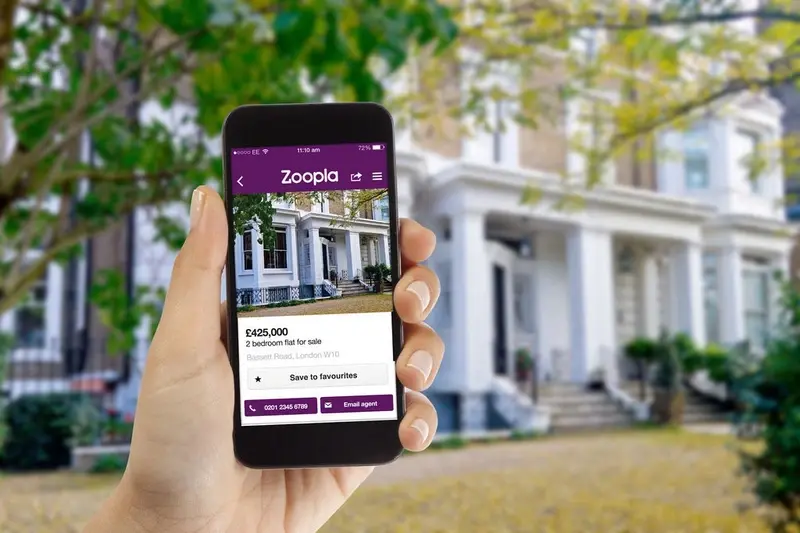

According to Zoopla’s founder and chief executive Alex Chesterman the rationale for the deal is to create a one stop shop for consumers to ‘research, find and manage their homes’ and the ‘enhanced engagement with users’ will ‘create a unique advantage’ for advertisers. In 2014 uSwitch had revenues of £62.9 million and adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) of £16.2 million with 50.3 million online visitors.

The terms of the deal sees Zoopla pay £160 million in cash - funded by internal funds and a new £150 million credit facility -with a further £30 million contingent on future performance. Zoopla is pledging to keep its policy of paying out 35% to 45% of profits in dividends after the tie-up is complete.