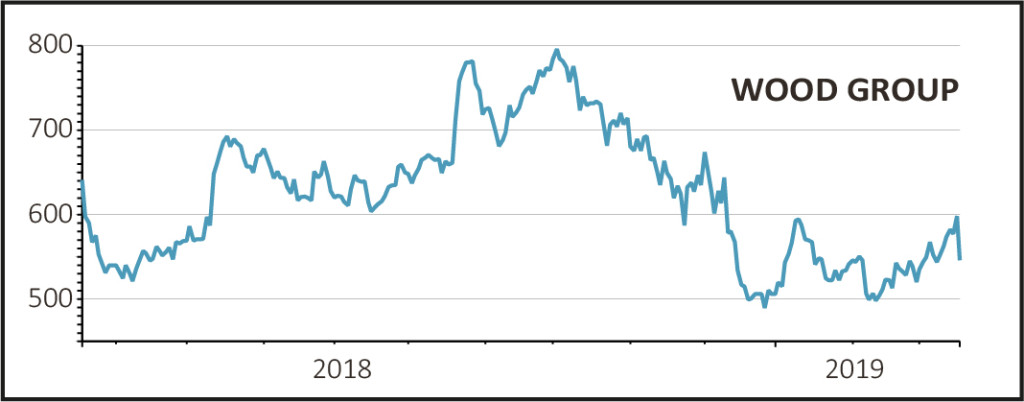

Full year results from oil services firm Wood Group (WG.) are getting the full on raspberry treatment from the market, the shares down 8.5% to 547.4p.

Close observers of the group had suspected these numbers would be subject to lots of adjustments and revisions, or in the words of investment bank Jefferies 'messy', and so it's proved.

READ MORE ABOUT WOOD GROUP HERE

Revenue surges 79% (11% on a pro forma basis factoring in its October 2017 acquisition of Amec Foster Wheeler) to $11bn. However, the company still posts a loss of $7.6m, narrowed from $30m a year earlier.

The loss reflects exceptional costs of $183m related to the integration of Amec, impairments at its EthosEnergy turbine business and pension adjustments.

The order book stands at $10.3bn, with 60% of 2019 revenue already secured, net debt is down slightly and at 2.2 times earnings is well within the covenant limit of 3.5 times, while the dividend is up 2%.

Jefferies noted ahead of the results that 'topline growth is at risk in the uncertain macro which brings back dividend risk, particularly as disposals continue to slip'.

Cantor Fitzgerald takes a different view. It says: 'Although exceptionals of $183m relating to the Amec integration stopped a return to profitability, these should see better performance in 2019 as the business is in better structural shape.

'Outlook is positive, and with higher oil prices leading to higher activity, the company is well placed relative to some peers.'