Shares in marine services provider James Fisher and Sons (FSJ) fell 5.1% to £11.67 after it became the latest firm to cut its dividend and report a fall in profit amid the coronavirus pandemic.

The FTSE 250 company was hit by the plunging oil price in the first half of the year, as prices were first adversely impacted by over production relative to real demand, which was then quickly followed by the global lockdown due to Covid-19 which saw demand plummet.

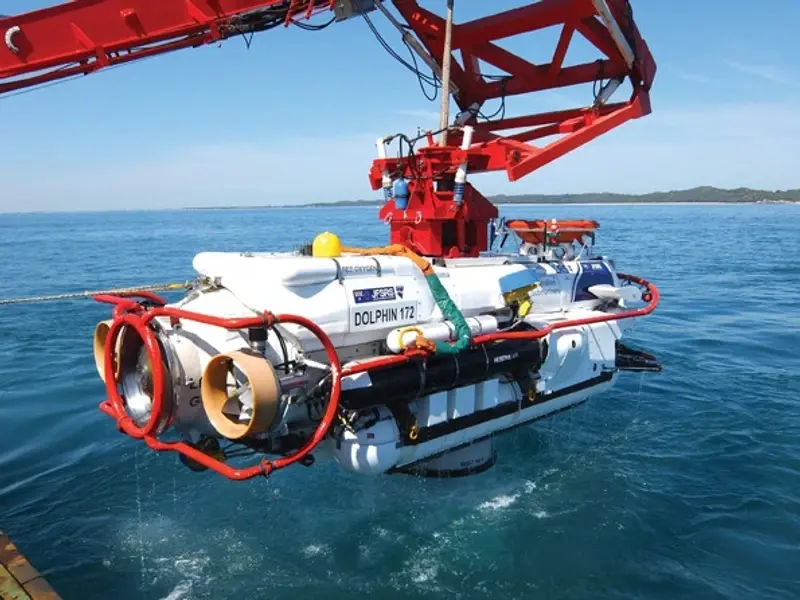

Although the oil price has since risen since its sharp drop, the firm is still recovering from the impact, with projects in its subsea operations in both its oil and gas and renewables divisions being deferred into the second half of 2020 and beyond.

In its results for the six months to 30 June, the firm reported a 59% drop in statutory pre-tax profit £7.1 million, as revenue fell 10% to £258.1 million. The company declared an interim dividend of 8p a share, down 29% compared to last year.

DIVIDEND A ‘POSITIVE INDICATION’

Shore Capital analyst Peter Ashworth said the results represent a ‘resilient performance’ in an ‘extremely challenging period’ for the company, and added that the fact it is paying out a dividend at all is a ‘positive indication’.

One bright spot for James Fisher was its offshore oil division, which saw the ‘strong momentum’ through the second half of 2019 continue into the first quarter of 2020, and although there was a negative impact in the second quarter, it reported a first half underlying operating profit 23% ahead of the prior period.

Part of the division, Fisher Offshore, won ‘good orders’ for decommissioning work, the firm said, adding this is area where demand is increasing.

Going forward, Edison director of research Neil Shah said investors will be closely monitoring any delays in James Fisher’s oil, gas and renewables projects as well as shifting oil prices.