Submarine rescue systems may sound niche, but it’s part of a division that is the strongest growing for marine and energy supplies company James Fisher & Sons (FSJ).

Shares noted in June that submarine warfare is big business, when Ultra Electronics (ULE) reached a deal to be the sole provider of underwater sensors to track submarines for the US navy.

James Fisher announces that its contract with the Indian navy to provide it with a submarine rescue system helped grow its specialist technical division by 20% to £75.5m. The company’s share price is up by 2.2% to £15.69 on the back of its first half to 30 June results.

The company’s CEO Nick Henry says ‘We’re the world leaders in submarine rescue’. He adds that even in times when countries were slashing their defence budgets, one area that was maintained was under water warfare.

Its other main submarine project, the second Shanghai Salvage saturation diving contract is also well underway. The company had provided Shanghai Salvage, or the China Ocean Engineering Services Shanghai, with a 300 meter saturation diving system in 2008 which made a record for the deepest dive in China in 2014.

This type of diving technique allows divers to work at great depths for longer periods of times, reducing the risk of decompression sickness. The contract is worth about £35m.

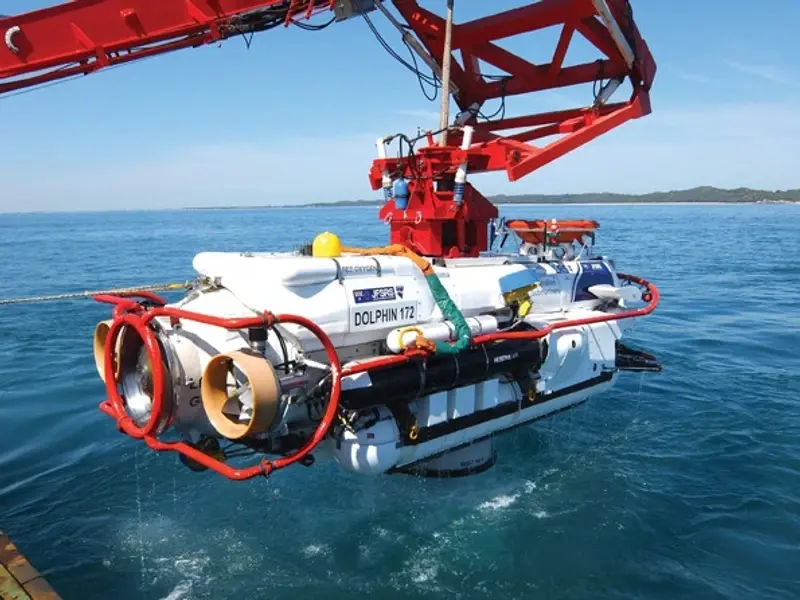

James Fisher is also providing various Special Forces and the coast guard with mini submarines, used to detect drug smuggling and also for defence purposes.

Analysts impressed

Alex Paterson, analyst at Investec, says the company has put in a ‘good performance and signs of improvement in offshore oil’.

Henry says that his company is not directly impacted by the price of oil, it doesn’t drill or is involved in exploration. However, if there is a lack of business confidence due to a falling oil price, businesses may respond by not doing the maintenance or rather doing the ‘bare minimum’. This would impact James Fisher as it performs the maintenance for the rigs and other infrastructure.

A diversified business, it is involved in renewable energy as well, helping to maintain offshore wind farms for instance, its first half results were better than Andy Douglas, analyst at Jefferies predicted. He says ‘James Fisher remains a well-run business with a solid long-term outlook and prospects’.

Patterson puts a price target of £17.25 on the stock, implying a 10% upside. With more navies across the world investing in their fleets, James Fisher’s expertise could well pay dividends. The company increased its interim dividend by 10% to 9.4p, which according to Henry is indicative of being able to grow the company by over 10% a year.