Shares in pubs group JD Wetherspoon (JDW) rose 3% to £14.55 following an upbeat trading update showing year-to-date sales up 7.4%.

Since the start of the year the company has opened five pubs and closed nine with no further openings expected for the current financial year ended 29 July.

The company has purchased £71m of freeholds which were previously tenanted, while spending £5.4m on share buybacks.

READ MORE ABOUT J D WETHERSPOON HERE

Brexiter chairman Tim Martin said: ‘The main issue for shareholders, which dominates debate, relates to the nature of the UK's post-Brexit relationship with the EU’.

He went on to say that the company has already put in place arrangements to mitigate the impact from a no-deal Brexit by replacing French champagne and brandy and Geman beer with alternatives from the UK, Australia and America.

JD Wetherspoon confirmed that its expectations for the annual results to be reported on 13 September are unchanged.

The year-end net debt position is expected to be circa £745m, consistent with prior guidance and represents a debt-to-EBITDA (earnings before interest, depreciation and amortisation) of 3.5 times.

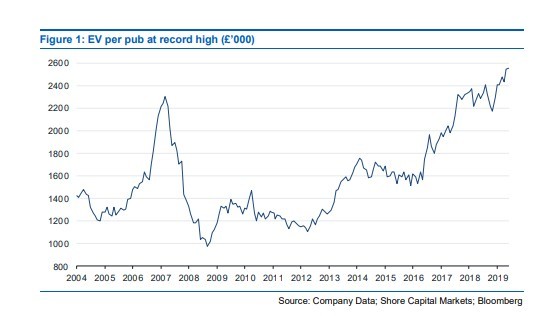

Greg Johnson at broker Shore Capital says that the shares trade on elevated metrics, for example the 2019 forecast price-earnings-ratio is 19 times while the enterprise value to pub ratio is trading at an all-time high as the chart below shows.