Chemicals firm Johnson Matthey (JMAT) has achieved two major milestones as it aims to disrupt the electric vehicle battery market with its enhanced lithium nickel oxide (eLNO) material by securing a new manufacturing plant and raw materials.

The innovative eLNO material is expected to offer more energy density and use less cobalt compared to traditional electric vehicle batteries amid a projected shortfall in cobalt supply.

READ MORE ABOUT JOHNSON MATTHEY HERE

Johnson Matthey remains on track to start commercial production of eLNO in 2021/2022 after securing its first commercial scale manufacturing plant near Warsaw in Poland.

SECURING SUPPLY AND DEMAND

In a bid to meet anticipated customer demand, Johnson Matthey says it can expand manufacturing capacity to up to 100,000 metric tonnes every year after sealing a 43 hectare plot in Poland.

Johnson Matthey’s second big breakthrough is a 10-year deal with Nemaska Lithium, which the chemicals company has been working with since 2016.

An agreement with Nemaska ensures Johnson Matthey has a supply of crucial lithium-containing raw materials for 10 years such as lithium hydroxide, which is used to create eLNO.

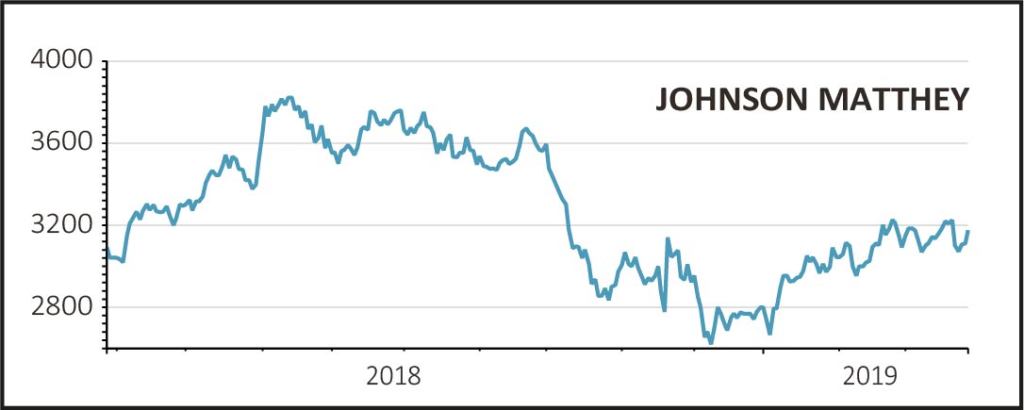

Despite the milestones, shares in Johnson Matthey have risen only 1.5% to £31.59 as investors await further progress.

‘In recent years, Johnson Matthey has stalled somewhat on fears that its core business of selling catalysts to reduce emissions from vehicles and industry will be undercut by a switch to electric vehicles,’ comments AJ Bell investment director Russ Mould.

Over the last year, shares in Johnson Matthey are up 2.1%.

Mould says the firm’s progress should reassure some investors and if Johnson Matthey can successfully commercialise eLNO, it has turned a potential threat into a business opportunity.