Retail shareholders in Provident Financial (PFG) might have been jumping for joy initially at the news that the company has received a bid, but on closer inspection there’s little to get excited about.

Subprime lender Non-Standard Finance (NSF) has made an all-share offer which values Provident at no more than last night’s closing price of 511p.

Provident shareholders are being offered 8.88 new shares in NSF, which closed last night at 58p per share, valuing Provident at £1.3bn in total.

Sadly for minority shareholders there’s no point holding out for a better deal as three big institutions which own just over 50% of the shares have already given ‘irrevocable undertakings’ to accept the current offer.

Invesco, Marathon and Woodford between them own 50.75% of Provident’s shares, which have lost 11% so far this year.

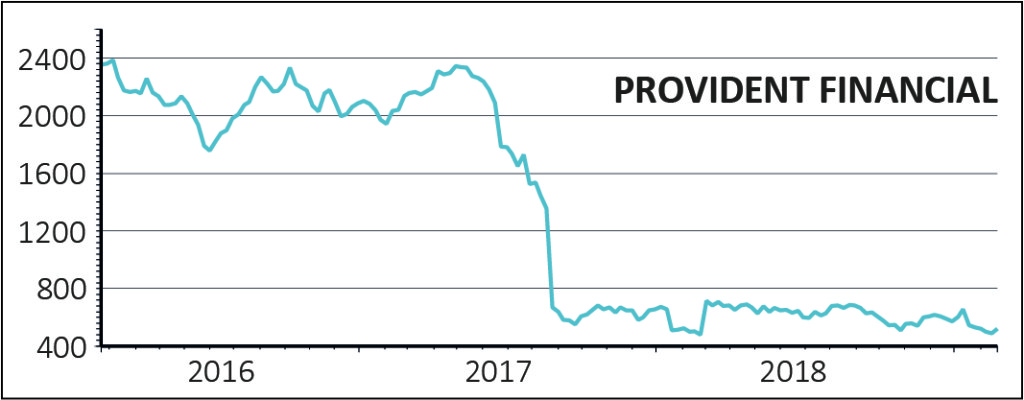

Provident has been beset by repeated regulatory investigations and profit warnings in recent years leading to the chief executive resigning in 2017 and dividends being suspended.

NSF originally approached Provident in January 2018 when the shares were trading as high as 675p but was rebuffed.

‘Since then Provident has further lost it way’ according to NSF founder John van Kuffeler, who until 2013 was chairman and chief executive of Provident over a 22 year period.

NSF sees ‘significant potential’ to turn Provident around and deliver ‘sustainable shareholder returns’ including cash distributions to shareholders by streamlining the business, selling off assets such as Moneybarn and Satsuma.

NSF shares jumped 4% to 60p on the news which has lifted Provident shares 2% to 522p due to the conversion ratio.