In 2019 UK companies have issued more profit warnings than at any time since the financial crisis. Research from accountant EY found that until September, 235 firms had already sounded the alarm.

This year has also seen household names like Thomas Cook and Debenhams depart the stock market in disgrace.

It is not hard to see why businesses have become more accident-prone given Brexit uncertainty and global growth concerns, but some stock market gaffes are so shocking they are worth looking at in a bit more detail.

By learning the lessons from these episodes investors might stand a better chance of running a successful portfolio. The Shares team has examined some key mis-steps over the past 12 months to determine what can be gleaned.

A CAR CRASH AT ASTON MARTIN

What happened?

Luxury carmaker Aston Martin Lagonda (AML) may be the name behind suave spy James Bond’s vehicle of choice but it has endured anything but a smooth ride since joining the stock market in October 2018.

The shares trade at a little over a quarter of the £19 IPO (initial public offering) price with the company beset by profit warnings and concerns over its financial position.

The £120m bond issue in September 2019 at an eye-watering borrowing rate of 12% summed up the firm’s dire situation given how it only seemed to be able to get financial support by offering a very high yield.

Recent speculation suggests a takeover bid from Canadian billionaire Lawrence Stroll might put shareholders out of their misery.

Lessons learned:

Don’t believe the hype with an IPO and always make sure you do your research. Investors drawn in by the prestige of the company’s name following its listing may have regretted backing the business.

The fact that the company had already gone bust seven times in its 105 year history was a warning signal as was the extremely patchy cash flow performance and the need for significant investment in research and development.

We also pointed out in an article in November 2018 that the company engaged in aggressive accounting practices, while the depressed state of the wider car industry was another reason to give the stock a swerve.

STAFFLINE SUNK BY RESULTS DELAY

What happened?

Staffline’s (STAF:AIM) problems began in January when it had to delay the release of its 2018 results due to allegations over payroll practices. After consulting with the tax authorities, the issue was identified as non-compliance with the national minimum wage, specifically payment for preparation time.

In fairness, Staffline was simply following its end-customers’ procedures for clocking in and clocking out yet it had to provision for additional costs and raise over £40m in capital to avoid breaching its banking covenants.

Lessons learned:

There was nothing investors could have done to predict events at Staffline. Regarding non-compliance with the national minimum wage and specifically non-payment for preparation time, the firm was working in strict accordance with its contracts with end-employers. The delay in publishing its 2018 accounts impacted customer confidence during 2019 while weak consumer confidence reduced demand for contract staff from the same customers. The key takeaway is that when a company delays publication of its results, it is usually bad news. The right response would have been to sell the shares on the day news of the delay broke. As we write Staffline shares are still down over 90% from their January highs.

SIRIUS MINE FINANCING DEBACLE

What happened?

Potash miner Sirius Minerals (SXX) stunned the market when it pulled a $500m bond offer in September. The bond was crucial to securing funding needed for its big mine in North Yorkshire, but Sirius couldn’t get investors on board. Its share price halved following the news, with its whole existence thrown into doubt. If Sirius is to get back on track, it needs to find a strategic partner - but this route will heavily dilute existing shareholders.

Lessons learned:

Popular with retail investors, Sirius Minerals was meant to be a poster child for UK mining and engineering with myriad economic benefits. But this is a reminder of the very high risks of investing in mining, even in the UK, and the big risks of investing in a firm trying to clear a major financial hurdle. As Sirius prepared to launch the bond, commentary from analysts implied there was no reason to doubt the issuance and that Sirius shares could surge once the deal was done. However, this is a clear lesson not to get swept up in the hype and to fully consider a company’s history in raising finance, investors’ appetite for companies not generating revenue as well as the general risks of the sector.

WEWORK DOESN’T WORK

What happened?

The aborted stock market listing of overhyped property firm WeWork will likely live long in the minds of investors, not least its chief backer, Masayoshi Son, the enigmatic founder of Japanese investment firm Softbank. The latter largely bankrolled the venture to startling valuations - $47bn at its last fundraising. From publication of a grand IPO prospectus to emergency rescue took two months and left WeWork valued at $8bn.

Lessons learned:

WeWork was never the type of next-generation, technology company it was made out to be, especially when there was a very similar sub-letting business listed on the London stock market. IWG (IWG) makes proper profits, throws off cash and pays dividends yet is valued at a tiny fraction of WeWork’s venture capital-puffed peak at £3bn. Softbank’s job is to spot emerging businesses capable of using technology to disrupt and dominate, and it has had many successes such as the Chinese retail platform Alibaba. But calling the odd dud is par for the course in a high stakes game. The real winners from the WeWork debacle are stock market investors, who refused to accept fantasy in place of hard fundamentals.

SPORTS DIRECT STUMBLES

What happened?

Sporting goods giant Sports Direct International (SPD) stumbled numerous times in 2019, its maverick moves further souring relations with the City. The Mike Ashley-controlled retailer spooked the market by delaying its full year results, a postponement that angered analysts and was later blamed on an unexpected bill from the Belgian taxman. Sports Direct also flagged that the problems facing acquired department store House of Fraser were ‘nothing short of terminal in nature’. Embarrassingly, Sports Direct also then struggled for some time to find a replacement auditor for Grant Thornton before RSM UK eventually stepped up to the plate.

Lessons learned:

This was a year in which the unorthodox corporate governance at Sports Direct came to a head, creating further negative sentiment towards the Shirebrook-headquartered shopkeeper and deal-hungry billionaire owner Ashley. His insatiable appetite for acquisitions created additional management distractions at a time when the core business offered more than enough challenges to keep his team busy, with major rival JD Sports Fashion (JD.) gorging on market share. Investors will be hoping a change of name to Frasers begins a new chapter for the cut-price tennis rackets-to-trainers seller.

TED BAKER UNRAVELS

What happened?

Quirky British fashion group Ted Baker (TED) had won a lot of fans on the stock market thanks to the strength of its brand, high margins and substantial cash flow.

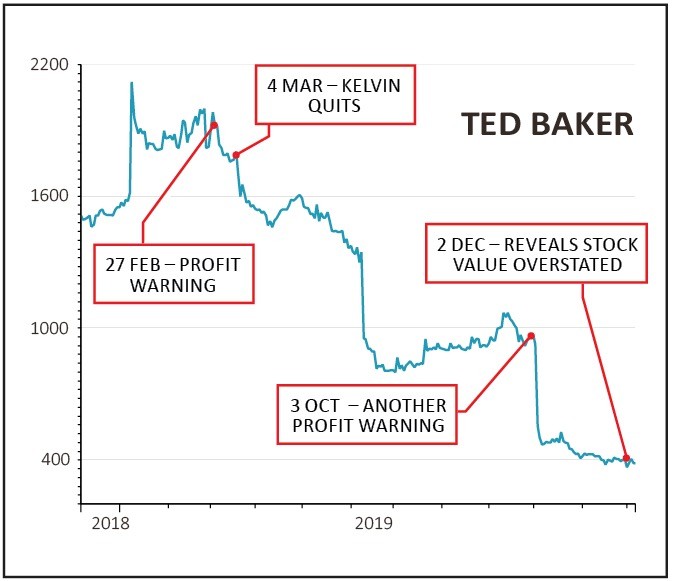

From mid-2018 onwards there were signs that all was not well as sales growth began to evaporate.

The departure of founder and CEO Ray Kelvin amid misconduct claims in March 2019 was preceded and followed by major profit warnings.

Arguably the biggest foul-up was yet to come as the company revealed on 2 December the value of stock on its balance sheet had been overstated by as much as £25m.

It then issued another profit warning, saw the new CEO and chairman quit and the dividend was suspended (10 Dec).

Lessons learned:

Investors need to be wary of companies with overly dominant executives. Partly because this means decisions and behaviour might not be robustly challenged but also because it creates a key person risk, with one individual integral to a company’s fortunes.

Kelvin was the one with control over Ted Baker’s design strategy and as such helped keep it ahead of the competition and his departure always looked likely when the allegations against him first emerged in 2018.

This article was originally published in Shares on 12 December 2019