A UK fund run by asset manager Liontrust (LIO) snapped up an 8.1% stake in rival Impax Asset Management (IPX) earlier this week after Impax’s biggest shareholder sold down part of its stake, according to a regulatory filing.

On Wednesday, BNP Paribas Asset Management sold 10% of its 24.5% holding in the specialist asset manager through broker Peel Hunt at a heavily discounted price of 510p per share.

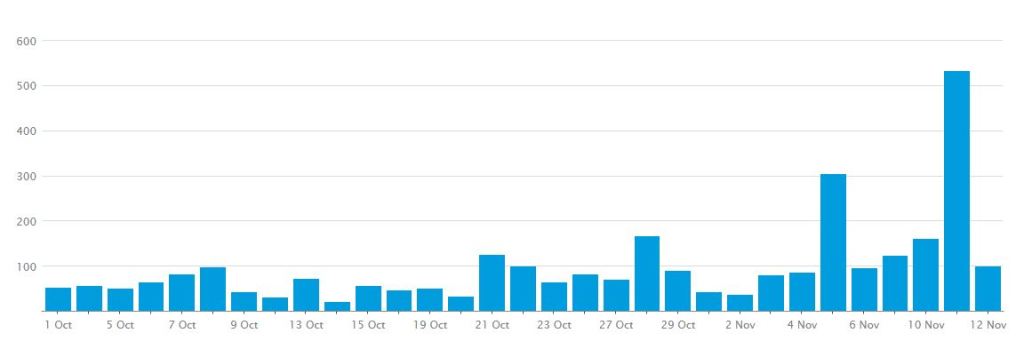

The sale of 13.6 million shares, which raised almost £70 million, sent the Impax share price sliding from 568p to 520p, while the number of individual daily trades soared to over 500 million according to the London Stock Exchange (LSE).

BNPP, which has owned a major stake in Impax since 2007, said it ‘continues to be supportive’ of the asset manager. Impax is the sole manager of five of the French bank's listed equity investment strategies focused on investing in environmental solutions, and has just extended its business partnership for a further four years.

The Liontrust UK Smaller Companies Fund, managed by Anthony Cross and Julian Fosh, already owned a small (1.28%) holding in Impax Asset Management before this week's purchase.

Impax has been one of the star performers of the fund management world in the last five years, with its shares gaining more than 1,200% as interest in ‘green’ and responsible investing has boomed.

In its latest trading update at the start of October, the firm posted a 34% increase in assets under management (AUM) to a record £20.2 billion in the year to the end of September.

Meanwhile, Liontrust reported assets under management of £20.6 billion in its latest trading update with another £5.7 billion of assets due to come in through the £75 million purchase of the Architas UK investment business at the end of last month.