Newly-listed legal firm DWF (DWF) releases a confident trading update for the year to 30 April with a forecast of ‘not less than 15%’ revenue growth and earnings before interest, taxes, depreciation and amortisation (EBITDA) in line with its forecasts at the time of floating.

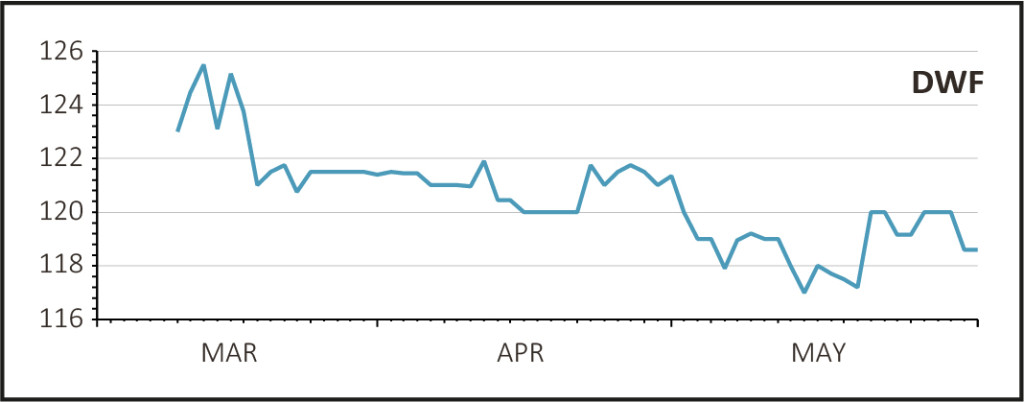

Shares add 1.7% to 120.5p, bucking the weakness in the broader market and taking them back to just below the March 11 offer price of 122p.

READ MORE ABOUT DWF HERE

Based on the last financial year’s revenues of £236m, today’s guidance points to turnover in the year to 30 April of at least £270m, or close to double the combined turnover of rivals Gateley (GTLY:AIM), Gordon Dadds (GOR:AIM) and Keystone Law (KEYS:AIM).

A large part of DWF’s growth has come through acquisitions: since 2013 it has bought or merged with Bridgehouse Law, C&H Jefferson, Cobbetts, Fishburns, Fox Hartley, Heenan Paris, Triton Global and Watmores.

The firm now employs over 3,000 people in 12 countries, having expanded in Australia, Belgium, Dubai, Italy and Qatar. Last month it announced the acquisition of Polish legal services business K&L Gates Jamka, adding another 85 staff.

Analysts at Stifel expect DWF to announce further acquisitions ‘given the international growth opportunity’, and view the stock as ‘highly attractive’ at the current price given its growth prospects out to 2021.