UK stock markets remain on edge with investors still mulling the potential fallout of the a possible 'yes' vote on Scottish independence next week. London's FTSE 100, which has traded within a tight range for the whole week, is just 0.1% higher at 6,813 in early deals after closing below the 6,800 mark on Thursday for the first time since 22 August.

Banking group Barclays (BARC) and supermarket Morrisons (MRW) are among the leading Footsie risers, up 1.5% at 228.8p and 1.3% at 180.1p respectively.

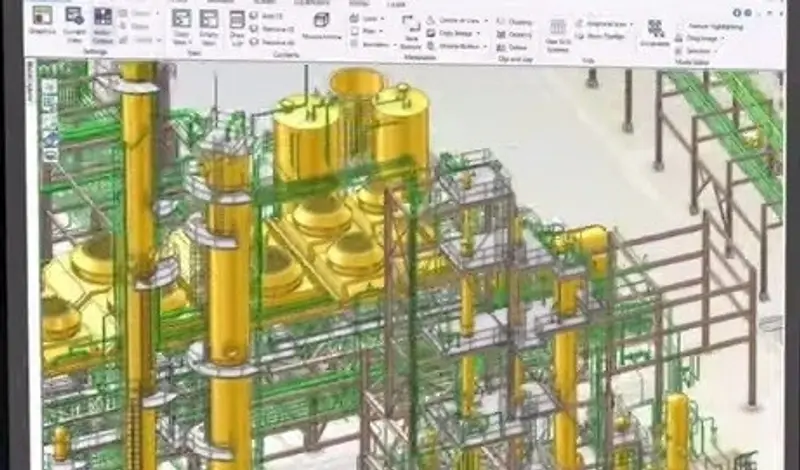

But the most significant faller today is FTSE 250 design and engineering software supplier AVEVEA (AVV). It issues a warning that first half revenues will fall into the £84 million to £90 million range. That's well down on last year's £108 million and below market expectations for £105 million, with currency movements and the timing of big contracts blamed, an issue flagged by Shares in April and May. Investors mark the shares sharply lower, down more than 21% to £17.09.

South American precious metals producer Fresnillo (FRES) is taking full ownership of the Penmont joint venture mines through buying out partner Newmont Mining for $450 million. Although most miners are selling, not buying, assets in the present environment, Fresnillo argues that investing throughout the commodity price cycle can create value. The shares rise 0.9% to 826.25p.

Full-year results from pubs operator JD Wetherspoon (JDW) beat expectations thanks to strong sales and operating margins slightly ahead of management guidance, sending the shares up 0.2% to 763.25p. Like-for-like sales in the six weeks of its new financial year rise by 6.3%, helped by soft comparative figures last year.

Online fashion retailer Boohoo.com (BOO:AIM) surges ahead 9.6% to 44.95p after reporting a 31% rise in sales for the six months to 31 August. 'The BOO investment thesis is evolving pretty much as we expected, management communication seems balanced and timely and as growth accelerates in the second half (of the current financial year), we expect the performance of the equity to follow,' says investment bank Jefferies.

Chinese sportswear seller Naibu (NBU:AIM) slumps 36.5% to 33p after half-year results show a decline in profit and suspension of the dividend despite record sales. The latter will hurt investors lured to the stock by a forecast 9% dividend yield earlier this year. The shares have long traded on a low price to earnings multiple as the market didn't believe the forecasts; and the market was right.

Drug delivery device-maker Consort Medical (CSRT) rises 3.4% to 979p on UK regulator MHRA clearing its e-cigarette Voke for sale.

Shares in heavy construction specialist Costain (COST) add 1.1% to 289p. The builder is appointed by Southern Water to help deliver its 2015 - 2020 (AMP6) investment programme in a joint venture with MWH worth around £200 million.

International staffing business SThree (STHR) reports gross profit up 18% year-on-year on a constant currency basis. However, a stronger sterling in the three months to end-August took some of the shine off the results. The stock was roughly flat at 341p.