The FTSE 100 is down 0.6% to 7,134.4 in early trade on Friday after markets in Asia sold overnight. That sell-off followed fears of a possible trade war after comments from President Trump on potential new tariffs.

Trump said he will impose import tariffs of 25% for steel and 10% aluminum without targeting specific countries.

Shares in Birmingham-based engineering FTSE 250 company IMI (IMI) confirms full year 31 December 2017 revenue increased by 6% to £1.75bn.

But the share price slumps 9.1% to £11.17 with underlying sales flat on 2016, after stripping away favourable currency moves and units business disposals.

Adjusted pre-tax profits are up 8% to £224m and the company has lifted its dividend 2% to 39.4p per share. Investors may take heart from an outlook statement that steers towards higher growth in the first part of 2018, where management anticipate ‘organic revenues to be higher than for same period in 2017’.

Private healthcare company Spire Healthcare (SPI) sheds 1.4% to 222p as it reveals a 68.7% drop in pre-tax profits to £16.8m. The company’s results for 2017 to 31 December also show a 7.1% increase in net debt to 462.8m.

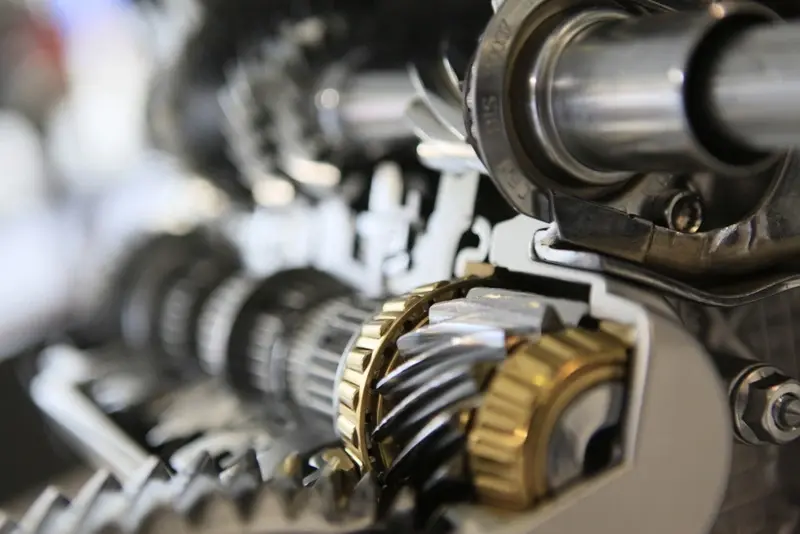

ENGINEER BATTLE TAKES NEW TWIST

Engineering company GKN (GKN) after confirming exploratory talks with US-based automotive business Dana that could lead to a merger of GKN's Driveline auto arm with its US counter-part.

GKN management have already firmed up plans to split its aerospace and atuo parts down the line, if it can stave off hostile takeover interest from UK turnaround specialist Melrose Industries (MRO).

This should all become clearer once shareholders in Melrose, and particularly GKN, get the chance to vote on their favoured course of action.

GKN shares dip 1.5% to 428.6p, while Melrose stock is similarly lower at 218.5p.

Exchange owner the London Stock Exchange (LSE) shares fall 3.2% to £38.18 on releasing its results for the year to 31 December 2017.

The company posted a 17% increase in revenue to £1.77bn and pre-tax profits of £564m, up from £364m in 2016. The company is still without a chief executive, although says it is making 'good progress' on its search.

Baby and children's goods company Mothercare (MTC) shares slump 11.5% to 22p as Legal & General (LGEN) reduces its stake to below 3%.

The size of the share price drop may suggest that this was a major reduction in the insurer's holding although this has not been confirmed.

Mothercare faces a bleak future with investors likely hoping that a rescue buyout may emerge for the struggling retailer.

BUMPER PACKAGING PAYOUT

A €1.00 per share special dividend announced by packaging company Mondi (MNDI) gets investors excited as it unveils on track full year 2017 results. Revenue increased by 7% to €7.1bn and pre-tax profits jumped 5% to €887m.

The company also increased its ordinary dividend per share by 9% to €0.62. Shares in the group nudge 1% higher to £18.615.

Staying in the packaging space, industry services company Essentra (ESNT) jumps 6% to 469.2p as it reports 2017 to 31 December results that offer some relief for investors.

The company’s revenue is down 2% on a like-for-like basis at £1.02bn compared to 2016, although it is has reduced its reported pre-tax loss by over 90%, coming in at £5m.

Essentra has been restructuring its business and now has four divisions; components, packaging, filters and specialist components. It has also been hit by hurricane problems in the Caribbean.

Chief executive Paul Forman says ‘the issues of the past were predominantly self-inflicted and therefore capable of reversal'.

SMALLER COMPANIES

Premium bar company Revolution Bars (RBG) sees its shares fall 2.9% to 165p despite decent results for the 26 weeks to 30 December. Sales during the period were up 0.4% on a like-for-like basis although the company says the figures are distorted by the absence of New Year’s Eve one of the most significant days for the business.

On the AIM market, staffer Harvey Nash (HVN) improves by 3.3% to 89.8p as it reports that a 6% hike in gross profit for its UK and Ireland businesses ‘despite widely reported Brexit-related market volatility’. Its trading statement also says that gross profit for the rest of the world will be down for the year ending 31 January 2018 due to a reduction in headcount.