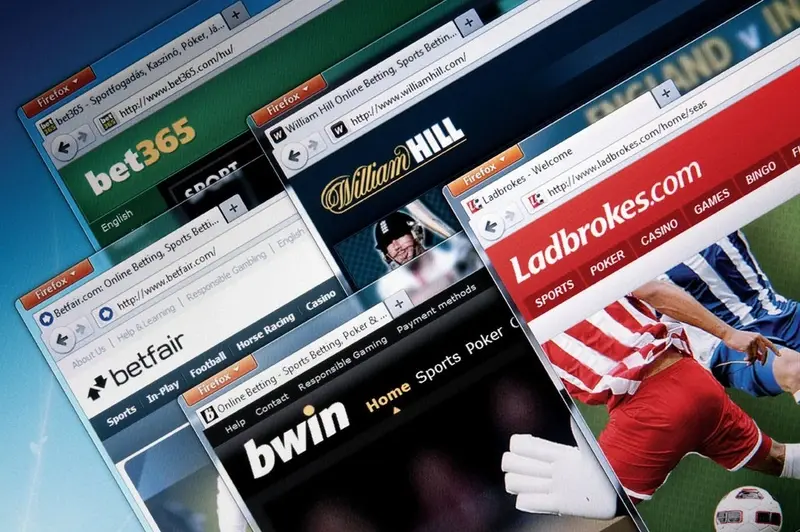

Savaged by the Budget, the gambling sector takes another hit after clarity on tax changes. William Hill (WMH) extends yesterday's share price decline with a further 2.5% drop to 342.7p after saying the impact of higher duty on gaming machines will be greater than expected. Having obtained clarity from the government on the tax changes, the bookmaker says the hit to earnings will be £22 million instead of the previous £16 million guidance. Ladbrokes (LAD) also falls on the news, down 4.3% to 134.3p.

Retailer Majestic Wine (MJW:AIM) loses fizz, falling 19% to 410p on a surprise profit warning. The UK's largest wine specialist warns taxable profits and like-for-like sales will be flat for the year to March following disappointing sales in 2014 to date. Consensus anticipated £25 million profits before the announcement and downgrades to last year's £23.7 million will now ensue. Majestic also guides towards 'a flatter profit growth profile' next year due to planned infrastructure investment to drive growth. We reveal analyst reaction to the profit warning in this news analysis.

Despite a cautious outlook statement, high street retailer Next (NXT) nudges up 1.7% to £66.90 on strong annual figures. Revered for its cash-generation, the fashion retailer grew taxable profits 11.8% to £695 million in the year to January with online and catalogue business Next Directory's sales 12.4% ahead.

Robust 2013 results from NHS IT supplier Emis (EMIS) pushes the shares 4.3% higher to 605p. Headline revenues rise 22% and recurring income is 17% up, plus net debt is down and cash generation up. EMIS also remains positive on its important renegotiations on its GP practice GPSoC contract. Shares interviewed CEO Chris Spencer in December.

Rapidly-growing revenues mean always-on servers technology company WANdisco (WAND:AIM) is maturing as a business quickly. The £300 million cap which floated at 180p, also wins a new big data contract with British Gas and confirms former Sage man Paul Walker as non-exec chairman, driving the shares 2% higher to £12.97. We take a closer look at the latest financial results here.

Fans of FTSE 100 testing company Intertek (ITRK) will be interested to hear about a smaller rival coming to the market. Exova plans to raise £110 million to pay down debt when it floats in April. The business has 117 laboratories in 22 countries, checking materials, parts and systems meet safety, performance and quality standards.

Shopping centre investor Intu Properties (INTU) falls 5.8% to 304.3p on a £500 million rights issueon a 42.5% discount to buy stakes in several assets.

Arbuthnot Banking (ARBB:AIM) improves 2.5% to £11.35 on a 76% dividend hike to 44p a share revealed in its full-year results. This includes news of an 18p special dividend and a 24% rise in pre-tax profits to £15.7 million.

Estate agency Savills (SVS) rises 3.1% to 635.5p on a 35% rise in full-yearpre-tax profit to £70.1 million. This funded a 19% dividend rise to 19p a share.

Housebuilder Crest Nicholson (CRST) slips 0.15% to 397.4p despite a trading update that reveals increasing sales volumes and strong revenue growth.

A fire hazard monitoring contract win sees tiny telematics supplier Trakm8 (TRAK:AIM) jump 7.5% to 57.5p. This is the second substantial contract this year for the company after January's motor insurance black box win.

Following the departure of long-standing EMED Mining (EMED:AIM) chief executive officer Harry Adams in September 2013, the interim CEO and finance boss also head for the exit. In comes Spanish management with Isaac Querub becoming the new CEO. The shares rise 5.4% to 9.88p as investors take the board shake-up to be a positive sign that EMED will finally get permission to restart the old Rio copper mine in Seville after years of set-backs.

Cash-generative ceramic tableware distributor Portmeirion (PMP:AIM) puts on 17.5p at 767.5p after announcing record sales, profits and dividends for calendar 2013. The Stoke-on-Trent-based manufacturer also issues a confident outlook statement, highlighting trading ahead year-on-year in the first two months of 2014.

Prospective unconventional oil and gas play Rose Petroleum (ROSE:AIM) gushes up 18.6% to 0.68p as it uses a fourth quarter update to highlight its acquisition of a package of US shale acreage. The $2 million farm-in deal will see Rose build a significant land position in Utah.