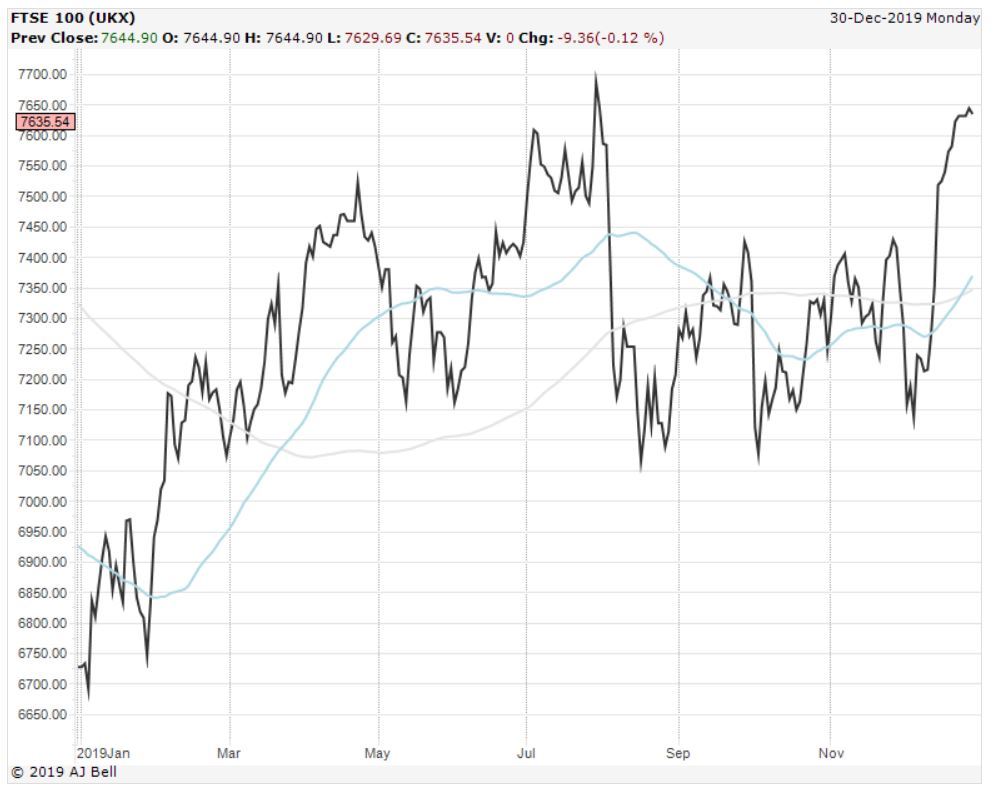

After eking out another small gain on Friday, UK stocks were lower at the open on Monday with the FTSE 100 index of leading stocks down 0.1% to 7,634 on a dearth of economic, political and company news.

Having made successive all-time highs last week, the FTSE 250 index of mid-cap stocks was also down 0.1% to 22,034. Volumes remained thin as most investors closed their books ahead of the holidays.

There was positive news for pharmaceutical giant AstraZeneca (AZN) as its ovarian and breast cancer drug Lynparza was approved for use in the US in treating patients with pancreatic cancer.

In phase-III trials Lynparza was shown to reduce the risk of disease progression or death by 47%. Following today’s news it is the only approved targeted medicine in biomarker-selected patients with advanced pancreatic cancer. Astra shares dipped 0.5% to £77.08 reflecting the weak backdrop.

There was also positive news from mining group Rio Tinto (RIO) regarding the resumption of operations at its Richards Bay Minerals (RBM) unit in South Africa.

A phased restart of production is in progress with RBM expected to return to full operations in early January, leading to regular production in early 2020. However shares in Rio Tinto also slipped, down 0.3% to £45.35.

Golde producer Petropavlovsk (POG) completed the triptych of good news with an update on its 31% iron-ore subsidiary IRC which operates on the China-Russia border.

The plant is running at close to full capacity, while iron ore prices remain stable. Meanwhile, the river Amur bridge is expected to be completed next year, reducing costs and shipment time to customers. Petropavlovsk shares gained 0.3% to 12.7p.

The biggest drag on the FTSE 100 was clothing retailer Next (NXT) which reports earnings on Friday. According to consultants at Springboard, footfall on Boxing Day was down over 10% across the retail sector with high streets faring worse still. Next shares gave up 2.1% to £71.11.