UK stock markets are on the front foot in early trade on Friday as investors are somewhat soothed by a bounce on Wall Street overnight.

The leading FTSE 100 index rises by nearly 100 points to 6,683.60 at 10am, recovering some of the losses chalked-up during pre-Christmas trading sessions. Much of that can be related back to action across the pond in New York, where major US markets regained a positive footing after a tough trading spell sparked by global political and economic uncertainty.

The Dow Jones index, which had slumped by more than 500 points earlier on Thursday, managed to recover ground later in the session to close the day 260-odd points up. Elsewhere, the broader based S&P 500 and tech-led Nasdaq also rallied by the end of the Thursday's trading day, ending the day 0.9% and 0.4% higher respectively.

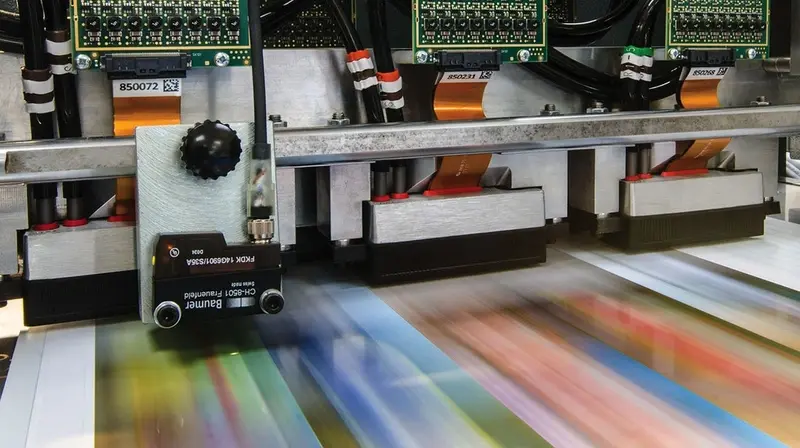

SALES SLOW TO PRINT FOR XAAR

As might be expected on the last Friday trading session of 2018, there is little in the way of meaningful corporate news to draw investor interest, although a trading update from inkjet printhead technology firm Xaar (XAR) does stand out.

The Cambridge-based company sees its share price slump more than 12% to 139.6p after warning that 2018 revenue will fall below expectations and the £100.1m earned in 2017. What can be now expected is roughly £64m of sales.

This largely relates to the slow take-up of a new line of inkjet printheads developed by Xaar, the same reason given for a similar warning in August. This marks the end to a very forgettable year for Xaar, having lost around two-thirds of its market value during 2018.

Elsewhere, building materials firm CRH (CRH) has completed the third phase of its €1bn share buyback programme. The Ireland-based group has so far bought back €800m worth of stock and today’s latest purchase sees shares in CRH rally 2.6% to £20.60.

NEW FUNDING BOOST

Among mid caps, Bank of Georgia (BGEO) sees its share price climb more than 5% to £13.80 after sealing new long-term funding. The bank has agreed a pair of deals worth $25m and $10m respectively, both with a maturity of five years.

The new cash will go in to supporting energy efficiency and smaller company funding for companies and projects in Georgia.

Leading the FTSE 100 higher is engineering firm Melrose (MRO), up nearly 4% at 161.85p, while gaming group GVC (GVC) heads the leading index fallers, its shares ion a near 2% slide at 664.5p.

Find out what else is moving on the UK stock market today by clicking through to our biggest risers and fallers pages here.