Shares in Spectris (SXS) are racing higher today, the market is betting long that the company's apparent recovery in the 2014 close run-in has long enough legs to stride into 2015. The shares jumped 5.5% to £20.71 today as the industrial controls, testing and analysis kit developer reported across the board growth between October and the end of December, combining for a 5% overall revenue increase. That compares with a more modest 2% sales rise for all of 2014.

'Trading in the fourth quarter was good, and we are pleased that Materials Analysis returned to growth in this period,' spelled out John O'Higgins, chief executive of the £2.45 billion company.

John O'Higgins, Spectris CEO

The improved performance was also spread reasonably neatly across the most important parts of the world for end demand. 'Regionally, like-for-like sales in the fourth quarter grew by 8% in North America and by 6% in Asia Pacific.' These two geographies were worth 28% and 30% of revenues respectively in 2013. That said, Europe remains off the pace, a region worth 29% of total income in 2013, and that includes the UK, arguably the brightest economic light here.

The question facing investors, however, is what's really changed? Spectris O'Higgins himself accepts that the 'macro-economic environment remains challenging,' and end market visibility seems no less opaque now than in October, when the company was forced to massage down expectations for the umpteenth time. Global capex investment refuses, so far, to show any real signs of recovery despite gradually improving macroeconomics. The main change seems to be that its Materials Analysis division is no longer on its uppers.

Spectris is a fine and innovative British company with years of experience and expertise, and management deserves credit for pulling the right levers during a challenging spell over which it has little control. New products have been launched thanks to Spectris' refusal to significantly reel-in R&D, unique growth initiatives have been set in play to suit each local market, while acquisitions have also helped.

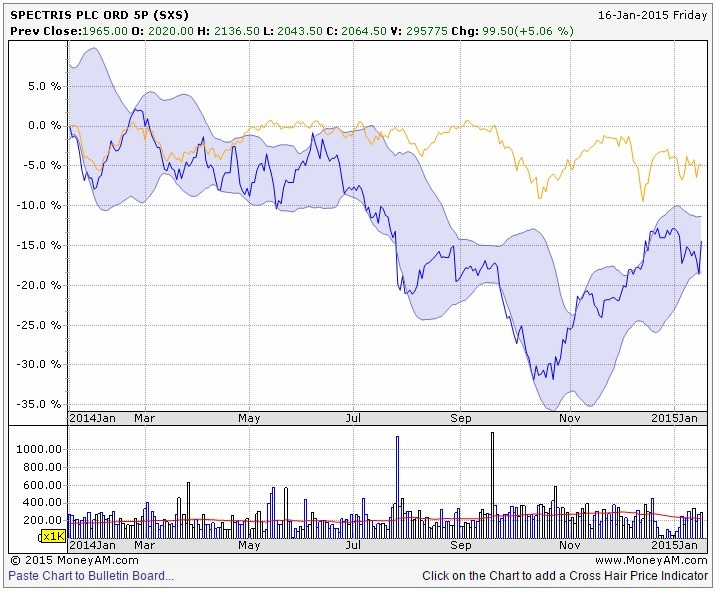

This bodes well for fortunes down the line for a company that fundamentally offers customers productivity savings and impressive innovation. Investors get effective management, above-average margins for this space, and oodles of cash. But given the 25% share price run since October, the market may be jumping the recovery gun.