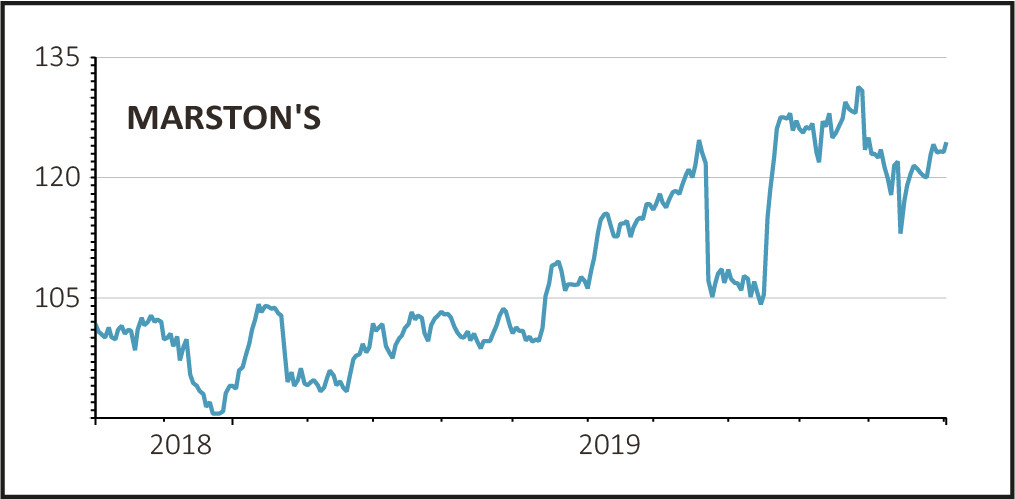

British brewer and pubs operator Marston’s (MARS) announced the sale of 137 pubs for £44.9m to Admiral Taverns, nudging the shares up 1.5% to 125p.

The disposal is in line with the company’s stated goal to reduce net debt by £200m before 2023 through the disposal of non-core assets.

‘We are encouraged by the level of market interest that this portfolio of pubs has attracted’, said chief executive Ralph Findlay.

‘This further underpins our confidence in achieving the accelerated £70m disposal proceeds target that we have set ourselves for the current year.’

IMPROVING THE RETAINED ESTATE

The portfolio is being sold below book value of £62.6m reflecting the required investment in the mainly wet-led portfolio and will result in a book loss of £17.7m (3p per share).

The exit multiple of 9.3-times earnings before interest, tax, depreciation and amortisation (EBITDA) is consistent with Martson’s book value across its leased estate according to analyst Greg Johnson at Shore Capital.

The sale achieves a dual purpose of reducing net debt and, importantly, increase the profitability of the existing estate by an average of 7% per pub, while improving returns of capital of 0.2%.