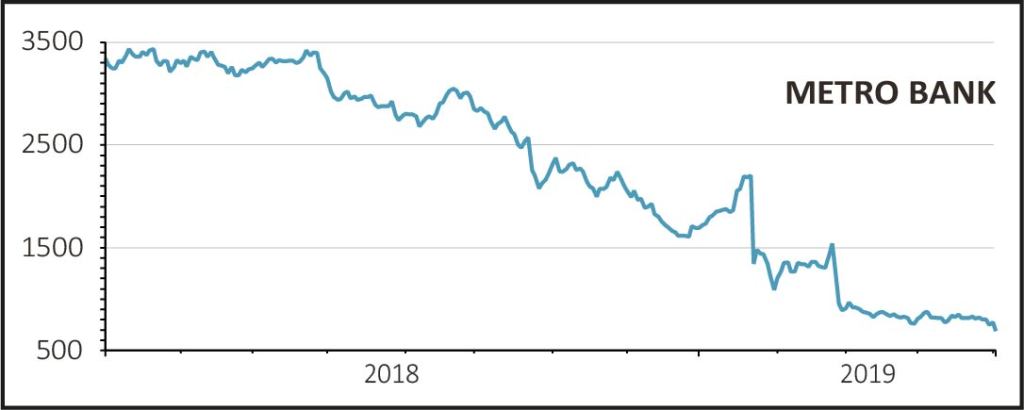

Shares in Metro Bank (MTRO) crash 15% to a new low of 660p as profit halved in the first quarter and it lost a number of large customers after it wrongly classified nearly £1bn of risk-weighted assets.

Pre-tax profit for the three months to 31 March were £4.3m, down 50% from the same period a year ago due to accounting changes and interest costs.

READ MORE ABOUT METRO BANK HERE

The number of new customers continues to rise across both personal banking and business banking but ‘a small number of large commercial and partnership customers’ withdrew deposits after the January trading update due to ‘adverse sentiment’.

This resulted in a net reduction in average deposits per branch of £2.9m compared with an increase of £4.7m in the fourth quarter of last year.

HOUSING LOANS PUSH

Loans increased over the period with mortgage lending up 9% in the quarter to £10.4bn as Metro pushes further into the residential market.

On the other hand the bank scaled back on what it calls ‘higher risk-density commercial and real estate lending’ with total loans up 3% to £4.5bn.

Shareholders will have little to cheer but at least the £350m equity raise scheduled for the second quarter is still on. The issue is fully underwritten by a syndicate of Jefferies, KBW and RBC so however low the take-up by retail investors the brokers will take up the rest at their own risk.