Investors in an M&G property fund remain trapped after the firm maintained a suspension in dealing in the fund’s shares so it can continue to sell properties to boost the fund’s cash position.

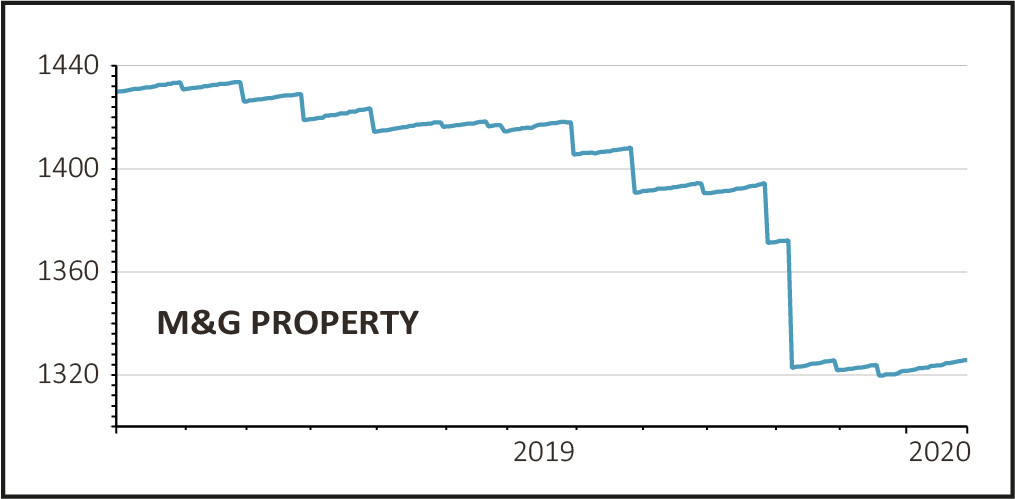

Dealing in units of the £2.3bn M&G Property Portfolio (B89X8P6) was suspended on 4 December, due to high levels of withdrawals by investors related to what M&G said was ongoing uncertainty over Brexit during 2019 and structural shifts in the UK retail sector.

Since the suspension started, M&G said it had exchanged or completed on the sale of £70.4m worth of assets, with a further £172.2m worth either under offer or in solicitors’ hands.

As at the end of December 2019, the cash held by the fund was 4.8% of the fund.

'CUSTOMERS PAY US TO INVEST MONEY, NOT KEEP IT IDLE'

M&G said the fund continues to be actively managed during suspension of dealing, with income payments and fund reporting as normal. It also said it will continue to waive 30% of the fund’s annual charge ‘in recognition of the inconvenience caused to investors.’

While the fund is down 7.6% overall in 2019, unlike Woodford funds it has pretty much held its value since the suspension.

M&G chief investment officer Jack Daniels said that while customers want ready access to their investments, ‘it’s also important that their long-term interests are protected.’

He added, ‘Historically, we have held a low cash buffer in the conviction that our customers pay us to invest their money, not to keep it idle - particularly in times of near-zero cash interest rates.

‘We believe that as an asset class, commercial property continues to have an important role to play in helping customers diversify their investment portfolios.’

'CASH NEEDS TO BE HIGHER BEFORE REOPENING'

AJ Bell head of active portfolios Ryan Hughes said the fund’s managers will want cash levels of the fund to be much higher than they are now before the fund is in a position to re-open again.

He said, ‘They will be very conscious to ensure there is a sufficient cash buffer following the re-opening, as the last thing they want is for the fund to have to suspend again if redemptions accelerate.’

Hughes added that the update from M&G, coming out at a similar time as Woodford investors being told about their first payments, is a reminder of the dangers of having illiquid assets in daily traded funds.

Hughes said, ‘While other major property funds have avoided succumbing to a similar fate, investors need to understand the liquidity risk they are taking when investing in assets that are hard to sell in challenged markets.’