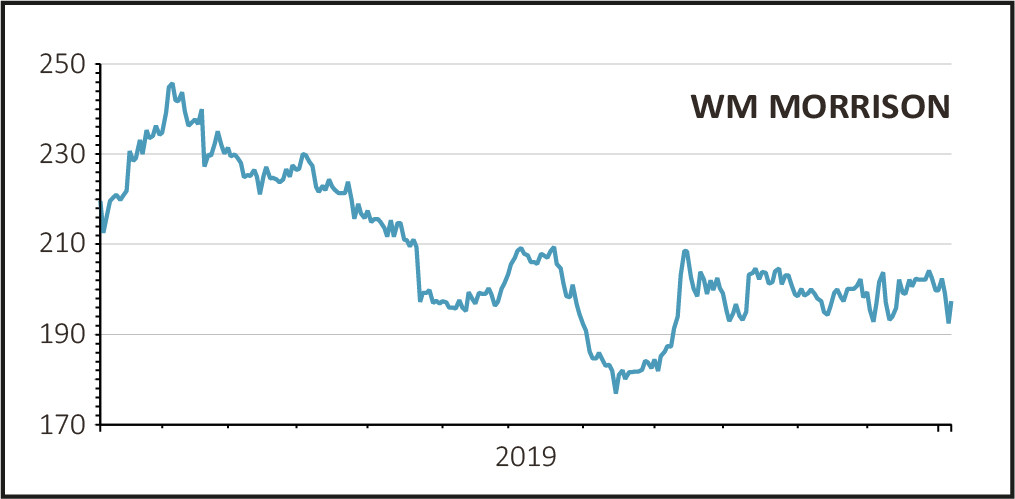

Shares in the UK’s fourth-largest supermarket group Wm Morrison (MRW) gained 3.5% to 199p despite what were generally seen as disappointing second half sales.

For the 22 weeks from 5 August to 5 January, group like-for-like sales were down 1.7% due to a negative contribution from the retail business and a flat performance at the wholesale business.

Including fuel, which has been a ‘highly promotional’ market in recent times, like-for-like sales were worse still, down 2.8%.

THIRD QUARTER REBOUND OF SORTS

Like-for-likes in the third quarter, from 5 August to 3 November, showed a slight improvement down just 1.2%, with retail sales down 1.1% and wholesale revenues marginally lower.

Retail conditions remained ‘challenging’ as consumers reined in their spending due to the ongoing uncertainty over Brexit, while wholesale revenues were affected by lower sales to McColl’s (MCLS).

Chief executive David Potts remained upbeat, however: ‘It was encouraging that during an unusually challenging period for sales, our execution was strong and our profitability robust.’

‘We managed costs well throughout the period, offsetting some of the impact on LFL sales of the challenging trading conditions and continued uncertainty amongst customers.’

Importantly, with four weeks of the year still to go, Potts said he expects 2019/20 profit before tax and exceptional items ‘to be within the current range of analysts' forecasts.’

NO FESTIVE CHEER

Missing from today’s update were like-for-like sales for the 9 weeks to 5 January, although based on the third quarter and half-to-date figures it looks as though sales were down around 2.5% in line with estimates circulating yesterday afternoon.

Morrisons said its ‘basket of key Christmas items was once again very competitive, with most prices the same as or lower than last year’, and once again its Free From range performed well racking up a 34% increase in sales over Christmas and the New Year.

The latest market share figures from Kantar for the 12 weeks to 29 December show total UK grocery sales in pounds grew 0.2% on last year with volumes down 0.7% and prices up by an average of 0.9%. For Morrisons, Kantar estimates sales over the 12 weeks fell 2.9% on an absolute basis although today’s figures point to a smaller fall.

Meanwhile data today from market research firm Nielsen suggests that UK supermarkets experienced their lowest growth over the Christmas period for five years, with sales in the four weeks to 28 December up just 0.5% despite shoppers making more trips than last year.