Used car dealer Motorpoint (MOTR) appears to be firmly back on track. Full year results confirm a strong rebound in second half profits and margins. A plumper-than-predicted annual dividend and positive outlook statement are also enticing buyers of the shares this morning.

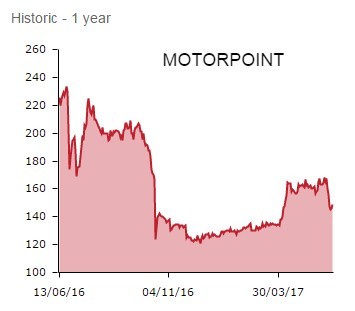

Shares in the Derby-headquartered car dealer improve 2.6% to 150p. That's still some way below May 2016’s 200p IPO issue price it must be said, but today's news is reassuring.

The nearly-new vehicle retailer’s pre-tax profits fell 13.7% to £15.7m on sales up 12.7% to £822m in the year to 31 March.

Forecasts were downgraded following a profit warning in October, although the annual profits haul is pleasingly ahead of more recent April guidance, where management flagged profits at the upper end of the market’s £14.6m-to-£15.5m range.

TALE OF TWO HALVES

This was a year of two distinct halves for Motorpoint. Its first half performance was negatively impacted by the vote for Brexit. Anticipating a dip in consumer confidence, management prudently cut prices to protect stock turn and reduced stock holdings, a move which crimped sales and margins.

Encouragingly, sales growth accelerated to 14% in the second half and gross margins increased sharply.

Motorpoint’s materially improved returns reflected strong recovery in gross margins per unit, the ongoing availability of prized premium brands (such as BMW, Mercedes-Benz, Jaguar and Land Rover) and a stronger take-up of its finance package.

GAS IN THE TANK

Motorpoint’s roll-out towards a UK target of at least 20 retail sites continues. New sites in Castleford and Oldbury opened last year, while a site in Sheffield, Motorpoint’s 12th, opened in April.

New sites are loss-making in their first year but move into profit in their second year.

Drawing confidence from strong underlying cash generation, Motorpoint’s final dividend of 2.9p is ahead of the 2.66p forecast by Shore Capital and takes the full year payout to 4.23p.

‘Year-end net cash was a little better than expected at £7.3m, so Motorpoint remains structurally debt free and has a strong financial constitution,’ thunders Shore.

‘We believe full year 2018 has started robustly for Motorpoint and whilst the private new car market has slowed post the strong first quarter of calendar year 2017, demand from the fleet operators is said to be growing “with substantially more vigour”’, adds the broker.

‘With fleet operators providing a significant proportion of Motorpoint’s vehicle demand, we believe vehicle availability remains strong with prices and margins remaining attractive.’

Numis Securities, a buyer with a 250p price target, writes:

‘With the roll-out to 20 sites continuing, recent openings building to maturity, and a significant like-for-like market share opportunity underpinned by Motorpoint’s leading customer proposition (choice, value, service), we retain our positive stance.'