Shares in plus-size fashion retailer N Brown (BWNG) edged up 0.5% to 39.1p on Thursday despite news of a sharp drop in annual profits and lower product sales for this year’s first quarter.

This was after the Manchester-based apparel purveyor said trading has continued to improve from the sudden and significant decline experienced in March, while detailing a refreshed strategy to return the business to sustainable growth.

CLOTHING SALES RECOVERY

Encouragingly, the firm said trading has continued to improve from the sudden and significant decline triggered by the lockdown in March. Clothing sales have started to recover from mid-March levels and demand for Home & Gift products has ‘remained well above the prior year’.

Although product sales are nearly 29% lower in the first quarter, the rate of decline has moderated to 21% in the last three weeks.

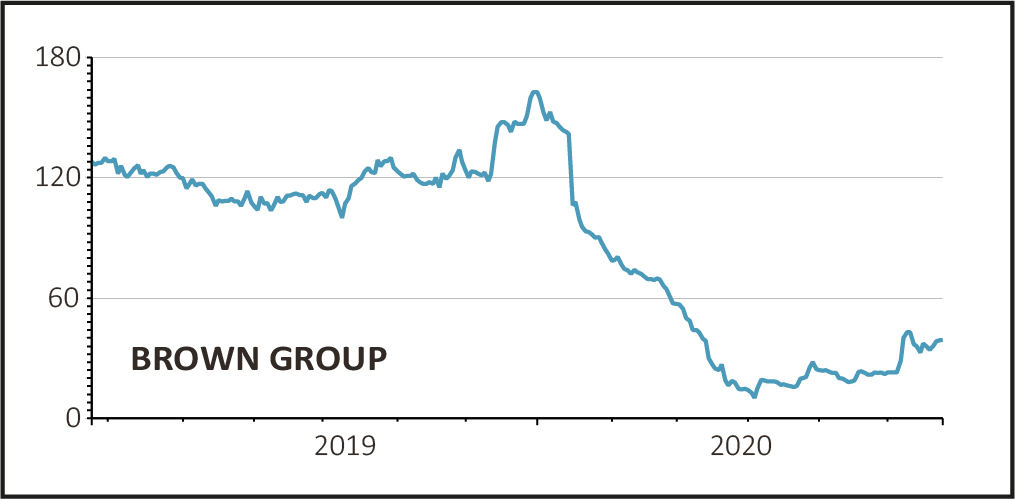

Having faced challenge after challenge, topped off by the coronavirus crisis, N Brown is emerging from a two-year restructuring in far better shape.

It has exited international markets, sharpened its focus on the UK, shuttered its physical stores and completed its transformation from a traditional to a digital retailer. Operating costs are significantly lower than last year and net debt has also decreased.

ANNUAL PROFITS PLUNGE

Results for the year to 29 February showed a near-30% drop in adjusted pre-tax profit to £59.5 million, as gross margins were eroded by cut-throat clothing competition and the company absorbed higher financing costs, on a 6.1% drop in revenue to £858.2 million.

N Brown, which responded to the pandemic by cutting costs and strengthening liquidity, passed the final dividend as previously announced.

Chief executive Steve Johnson explained: ‘In a year of restructuring for the group, Simply Be, JD Williams, Jacamo and Ambrose Wilson all grew digital revenue and following further progress in the first quarter of this financial year, 91% of our product revenue now comes from digital channels.’

Johnson added: ‘The retail environment remains heavily promotional and the regulatory challenges in financial services have required us to adapt and evolve our offer, but our commitment to driving operating efficiencies is creating the right platform for the future.’

THE SHORE CAPITAL VIEW

‘Product sales trends are improving from recent lockdown lows,’ said Shore Capital, ‘but visibility remains limited in Financial Services. The UK consumer economy is in a tough place and whilst choppy waters abound, we believe N Brown is in far better shape to traverse them than it was just 15 months ago, with the potential to emerge with more reward for shareholders.’

The broker insisted ‘a refreshed senior management team has undertaken serious work in recent months amidst the coronavirus crisis, making N Brown a more robust, more relevant, more efficient and more cash generative business. There is more, of course, to do, but we are encouraged by progress.’