Full year results from the UK's power transmission operator National Grid (NG.) today have been completely overshadowed by renewed talk of nationalisation.

This is not new speculation but it is a story that has been re-energised by the Labour party putting its plans into an official announcement today.

That announcement gives some detail on what a future Labour government might do, the theory being to strip investors of their dividends and plough the perceived extra cash into creating a new green industrial revolution to tackle climate change, with National Grid front and centre.

Investors are clearly spooked, National Grid shares down 3% at 818p.

RENEWABLES TRANSITION

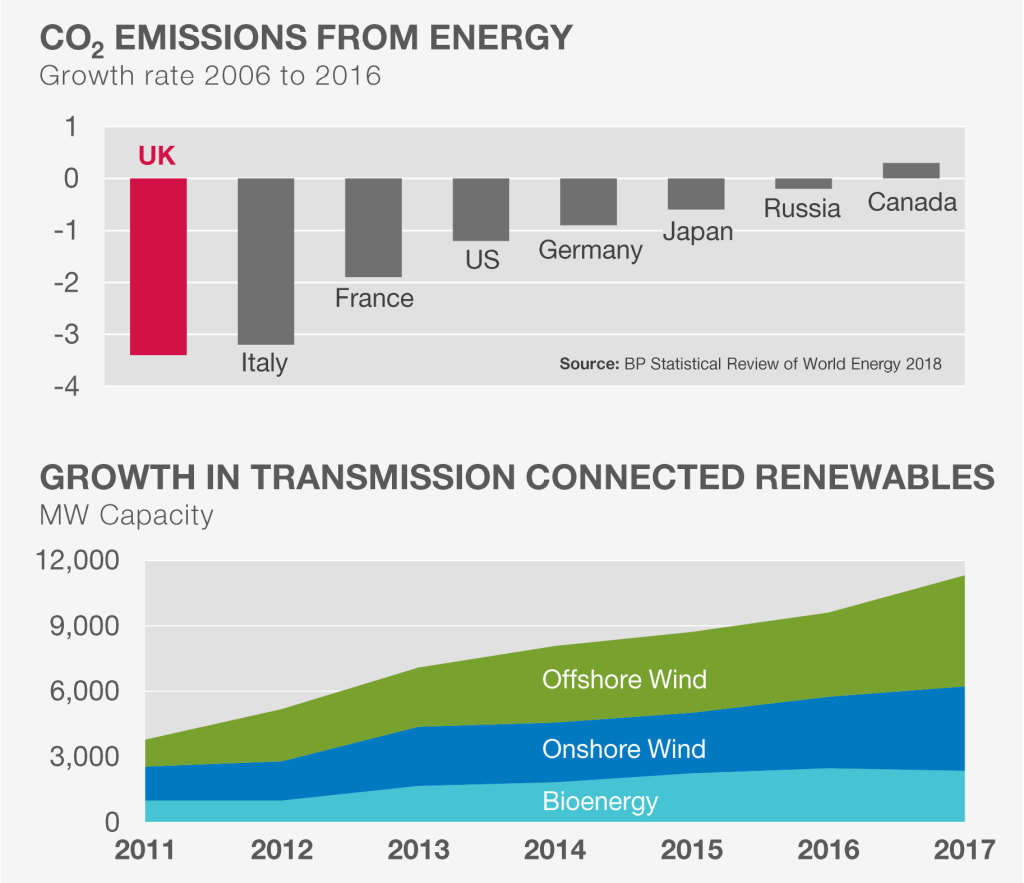

The arguments on both sides are complex but it is worth pointing out that Labour's proposals do seem to miss the point that National Grid is already at the forefront of facilitating a transition away from fossil fuels to renewables as the UK's energy mix changes, as the charts below imply.

It was reported recently that the UK went a whole week without the use of fossil fuels, highlighting the progress the UK is making in embracing a new greener, cleaner energy future.

There are obvious questions of such a plan, such as the price existing shareholders would get for their stakes, the impact on the national purse and how damaging the signal sent to private sector investment would be, particularly if shareholders find themselves railroaded into accepting nationalisation terms.

PROFITS DOWN BUT PAYOUT UP

As for the full year results, they show operating profit down 2% to £3.4bn, slightly below consensus estimates. But more importantly for shareholders, dividends continue their upward trajectory, the payout rose 3.07% to 47.34p for the full year, keeping to the group's promise of RPI inflation-matching increases.

That implies an income yield of 5.76%, based on today's share price.

READ MORE ABOUT NATIONAL GRID HERE

The other big issue facing investors is the next regulatory review, when regulator Ofgem will set energy operator price controls that determine how much National Grid can earn on its regulated assets.

Currently in the consultation phase, the next regulatory pricing period will run for eight years from April 2021.

What this framework means in practice is that National Grid is given an incentive to earn a greater return if the network is run more efficiently and delivers extra benefits to customers. Ofgem had initially indicated a returns range of between 3% and 5% while National Grid has argued for 5.5%.

The outcome will dictate to a large degree how much surplus cash National Grid will be able to generate to pay out as dividends in future years.

A final decision is expected on 23 May.