Nothing ventured, nothing gained, as the saying goes, but NCC (NCC) management have today also shown an uncompromising ethos when it comes to cutting lose from a folly. In today's otherwise strong full year to 31 May results (read here) the big story is its decision to axe its Domain Services unit and write it off as a tried it, didn't work, killed it off venture.

This was the business designed to provide secure web addresses for organisations under the .trust domain name branch, the .com or .co.uk equivalent. With a potential ballooning number of new top level domains (TLDs) coming on stream over the next few years this was a bright idea. Instead of, say, ABC Bank, having to invest in and manage a host of new internet addresses to underpin its branding, it would push everything through the .trust route, security monitored by NCC.

But it has not worked and CEO Rob Cotton has pulled the plug at the cost of an £11.8 million write-down, the bulk of a £13.7 million over all value readjustment, and a total of £18.9 million of one-offs. This comes as no shock, Shares flagged the likelihood more than two months ago - the writing was definitely on the wall.

'In true NCC style, the company has now taken the bold move to cut its losses and divest the business,' comments Megabuyte analyst Indraneel Arampatta.

'While secure domains are still seen as a sensible idea, the market has taken a long time to develop and enterprise adoption has been low,' spell out analysts at Jefferies this morning.

'The division lost £1.7 million and the decision has been made to divest or reallocate the division’s assets,' say N+1 Singer analysts. 'We believe this is the correct decision and will allow the group to focus on the core business,' they chime in.

Elsewhere, things are going great guns. NCC saw excellent growth in revenues, up 56% to £209 million, driven almost solely by the Assurance division, and in line with market expectations. Profits also improved greatly, with adjusted operating profits up 46% to £38.4 million, with Assurance’s contribution up 52% to £25.8 million, Escrow grew 6% to £20.1 million, while adjusted EBITDA grew 48% to £43.7 million.

Assurance consists of Security Consulting, to which the formerly AIM-listed Accumuli was integrated, and Software Testing & Web Performance. The former saw revenue growth of 87% to £139 million, while the latter grew a more modest 33% to £30 million.

'This is an excellent set of results from NCC, as expected,' agrees Megabuyte's Arampatta. 'Any surprise and potential irritation by investors about what has essentially been a failed endeavour has been offset by the fact that the divestment removes a drag from financial performance and valuation progression.'

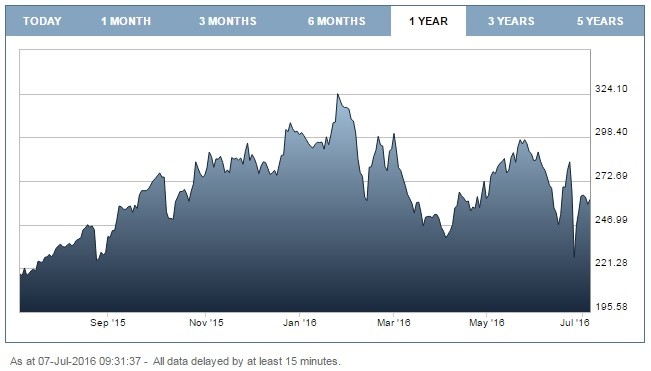

Not half. Investors love the strategic and trading news, the share price soaring more than 10% to 289.6p, just a little more than 10% off the stock's 324.1p all-time record.

Domain Services was an adventurous roll of the dice by NCC. It's disappointing that nothing has ultimately come of it but investors should celebrate the entrepreneurial nous to try something new, when so many stock market company corporate strategies are unambitious and grey.