Shares in hospital operator NMC Health (NMC) have continued to tumble this morning after it issued a detailed rebuttal to accusations from short seller Muddy Waters.

The firm’s share price has fallen 13% so far this morning to £13.38, a far cry from the £25 the shares were trading at just five days ago before activist Muddy Waters published a scathing report on the business.

Muddy Waters, which earlier this year targeted popular retail stock Burford Capital (BUR:AIM), said it was shorting NMC Health because of ‘serious doubts’ over the company’s balance sheet.

It highlighted specific concerns about NMC’s asset values, cash balance, reported profits and reported debt levels.

ACCUSATIONS 'FALSE AND MIS-LEADING'

In its response published yesterday evening, NMC called Muddy Waters’ accusations ‘false and mis-leading’ and outlined ‘factual inaccuracies’ in the activist investor’s report.

However, not helping NMC's case is a report in the Financial Times today which says the firm held talks to raise hundreds of millions of dollars in off-balance sheet debt to help it fund new hospitals.

READ MORE ABOUT NMC HEALTH HERE

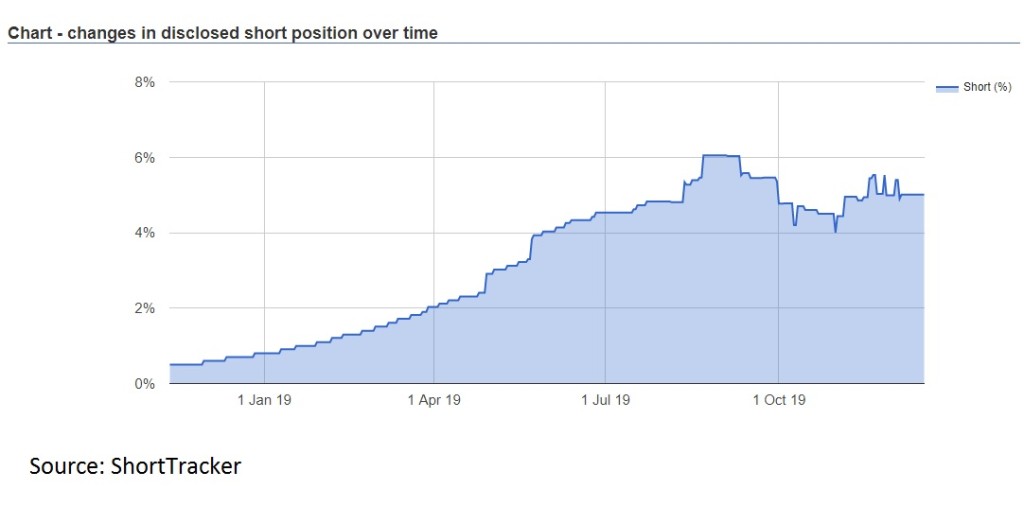

One of the most shorted stocks on the FTSE 100, NMC has faced increased scrutiny from analysts, investors and short sellers this year regarding some of the funding techniques it uses which don’t count towards official debt levels, and therefore won’t appear when an investor looks at the company’s accounts.

According to the FT which cited ‘people familiar with the matter’, while NMC has made public statements reassuring investors about its limited use of off-balance sheet funding techniques, this year it has looked to raise €200m through a complex chain of special-purpose vehicles.

FT ARTICLE PART OF 'LONG-RUNNING BEAR ATTACK'

Responding to the FT report this morning, NMC said the article ‘appears to be a part of a long-running bear attack on NMC Health’.

It said the article is ‘based on false information and finds speculation regarding a transaction that didn’t occur to be completely unproductive.’

The company added, ‘NMC regularly meets investor and potential lender groups and takes its obligations seriously.

‘As a listed company NMC is held to high standards in relation to reporting and disclosures and engages with a variety of top tier professional firms to ensure adherence to such standards.’