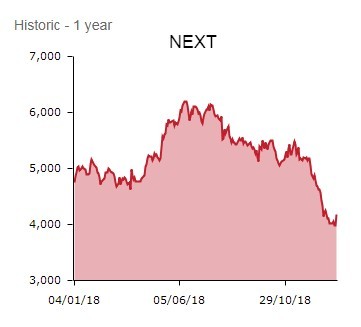

Clothing and homewares retailer Next (NXT) rallies 4.3% to £43.57 after reporting a surprise rise in Christmas sales, confounding fears over dire festive trading. The high street bellwether’s resilient Christmas showing is admirable given how bad November was for the sector.

Shares in rivals Marks & Spencer (MKS), Primark-owner Associated British Foods (ABF), Debenhams (DEB), ASOS (ASC:AIM) and Superdry (SDRY) are also spinning higher on the positive read-across.

AN ADMIRABLE FESTIVE SHOWING

Traditionally the first major listed retailer to update on Christmas trading, Next says full price sales between Sunday 28 October and Saturday 29 December rose 1.5% year-on-year, bang in line with the guidance given in September.

Encouragingly, strong sales in the three weeks prior to Christmas, combined with a good half-term holiday week at the end of October, made up for disappointing sales in a difficult November.

Continuing the long-standing trend, online provided the growth for Next over the peak selling period, with sales shooting up 15.2%.

Unsurprisingly, Next’s retail business suffered alongside the rest of the structurally challenged high street, its sales declining by 9.2%.

WHY NEXT IS A 2019 PICK

Retailers are facing a perfect storm of rising costs, channel shift online and Brexit-induced consumer uncertainty and the Christmas run-up was tough amid a fall in consumer confidence and a flurry of margin-crimping discounts.

Even web-based fashion phenomenon ASOS issued a punishing pre-Christmas profit warning, hammering shares across the sector.

Nevertheless, Shares selected high-quality retail name Next as one of our 2019 picks in the belief management, headed by estimable CEO Simon Wolfson (pictured below), can navigate the tricky high street backdrop.

MILDEST OF PROFIT WARNINGS

Removing some of the gloss from a robust festive performance is Next’s full year pre-tax profit guidance, which is reduced by a modest 0.6% from £727m to £723m.

The expected £4m profits shortfall for the year to January 2019 reflects the increased costs associated with higher online sales, as well as bumper sales of seasonal personalised gifts and beauty products.

These generate lower margins than the clothing ranges upon which Next relies for the bulk of sales. Annual full price sales growth guidance of 3.2% is left unchanged.

UNCERTAINTY REMAINS

However, turning to next year, Next forecasts full price sales growth slowing to 1.7%, implying a modest 1% year-on-year pre-tax profit decline to £715m.

‘In the year ahead, we are assuming a similar economic environment as that experienced in the second half of the current year,’ says Next. ‘Within this guidance, we expect retail sales to be down 8.5% and online sales to be up +11%. Any sales forecast made in January comes with a high degree of uncertainty.

'This year's uncertainty around the performance of the UK economy after Brexit makes forecasting particularly difficult. We have not factored into our sales estimates the potential benefits of a smooth transition or the downsides of a disorderly Brexit.’

Given Next’s copious cash generation, the board has reinstated the share buyback programme of £300m for full year 2019/20.

Russ Mould, investment director at AJ Bell, comments:

‘Retail is currently about survival of the fittest and Next is certainly looking like one of the healthiest in its pack. A decade ago, Next reporting a 9.2% drop in high street sales would have been disastrous. Yet today no-one will be surprised by such a performance as it reflects a structural change in how we shop for goods.

‘The fact that Next has barely changed its earnings guidance despite high street gloom is deemed a major success by investors, hence why its share price has shot up on the news.’

Shore Capital analysts Greg Lawless and Clive Black note that ‘given the macro economic environment and difficult clothing market through the Autumn, management should be applauded for such a credible trading update'.

‘Full price sales are in line with expectations and pre-tax profit guidance has been nudged down, which we think is an excellent performance considering how bad November was for the sector and the scale of the downgrades we have seen elsewhere in fashion and clothing,’ adds broker Liberum Capital.