Mergers and acquisitions can be very positive for share prices, especially for companies on the receiving end of a bid. Yet the flip side is that failure to find takeover deals can be a negative for acquisitive companies, which brings packaging specialist Essentra (ESNT) into focus. Analysts reckon M&A deals and a big investor strategy day in November will be catalysts for the £2 billion cap?s share price, but we have doubts - particularly as takeovers are not guaranteed - and believe the shares look too expensive at present.

Fundamentally we rate Essentra as an excellent company with proven track record of enhancing earnings through well-picked acquisitions and subsequently raising profit margins. Yet failure to find a suitable acquisition in the near-term could leave investors disappointed. The forthcoming strategy day is also focused on long-term goals under the banner of ?Vision 2020?. Unless there?s something radically new in this announcement, it is hard to believe the shares would advance near-term given the multiple years to achieve any goals in this strategy.

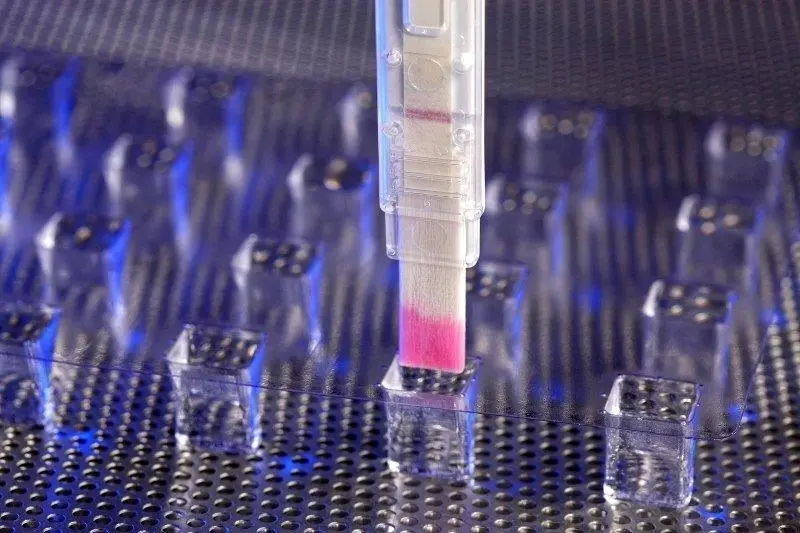

Essentra trades on a 2014 price-to-earnings ratio of 19.3 based on consensus earnings per share of 42.7p. That?s very high for a business with a complex group of end markets. Essentra, which makes tens of thousands of niche products from cigarette filters to roller chair casters, has around £250 million of headroom under its existing bank facilities to fund a new takeover deal.

A larger transaction might also be accompanied by a rights issue, a template it followed with some success in 2013 when it bought Contego Healthcare for £160 million. As part of that deal, the company issued shares at 675p, a slight premium to where its stock was trading before the announcement. Investors that took up the rights have been paid back handsomely in the interim given Essentra now trades at 823.5p. Indeed, the shares have risen by 85% in value since we highlighted the company?s attraction a few years ago (see Shares, Griller, 15 Mar ?12) when it was called Filtrona.

There is more to Essentra than just acquisitions. Chief executive officer Colin Day, previously finance boss at Reckitt Benckiser (RB.), is regarded as among the best in the business. Since his April 2011 start date, Essentra has delivered on an ambitious set of targets as part of its Vision 2015 initiative. It has delivered high levels of cash conversion and a progressive dividend.