Shares in Royal Dutch Shell (RDSB) gave up 1% to £22.50 on Friday after the oil giant lowered its sales and margin guidance for its oil and chemicals businesses and said it would take a fourth-quarter charge for the weakening economic outlook.

The downstream oil division, which is already enduring lower refining margins due to the ‘continued weak macro environment’, is expected to sell between 6.5m and 7m barrels of oil products a day in the fourth quarter against 6.7m to 7.35m barrels in the third quarter.

Marketing margins are expected to be lower ‘due to seasonal trends’ and lower than last year due to crude prices impacting retail profits.

Meanwhile sales volumes in its chemicals division are seen at 3.4m to 3.6m tonnes against 3.9m to 4m tonnes in the third quarter due to outages and ‘substantially lower asset utilisation’.

In addition, cracker and intermediate margins ‘are expected to be materially lower than in the third quarter’ due to weak markets.

LITTLE SEASONAL CHEER FOR SHAREHOLDERS

Adding to the depressed outlook, the firm is taking between $100m and $200m of additional write-offs for upstream assets compared with the fourth quarter last year, a similar amount for decommissioning other assets and a charge of between $500m and $600m for deferred tax charges.

None of these provisions affect cash-flow but all are expected to have a negative impact on earnings compared with last year.

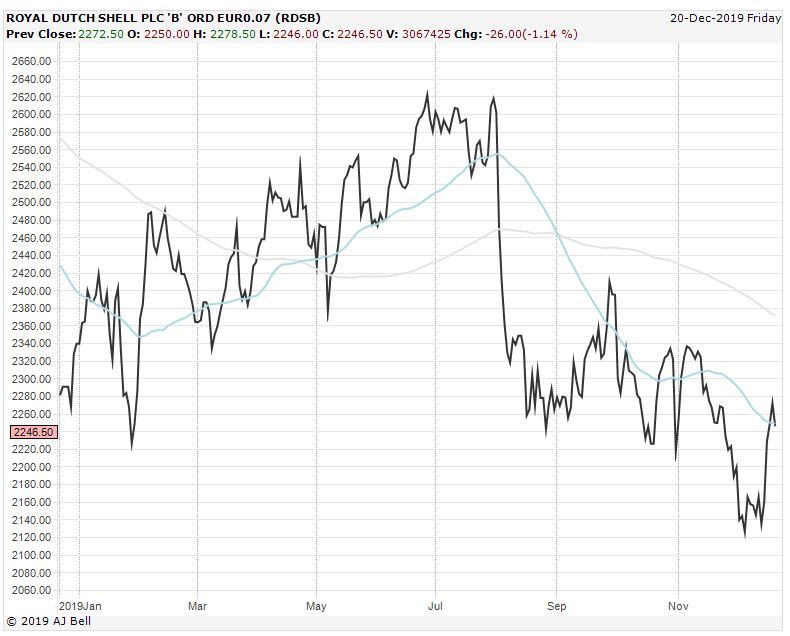

As Russ Mould, investment director at AJ Bell, points out, energy is the worst performing global sector this year with a total return of 4.4% in sterling. Shares in Shell are actually down 3% this year compared with a 12% gain for the FTSE 100 index.

‘It is possible to argue that oil’s woes are merely cyclical’ says Mould. ‘The MSCI energy sector is trading at the same level as it did in March 2005 and the actual oil price is barely changed from August of the same year in nominal terms. This may not be a coincidence. In inflation-adjusted terms, this means oil is cheaper still.

‘The problem seems be one of supply thanks to the boom in US shale oil production, which is now exceeding 9m barrels a day equivalent up from 1.5m a decade ago.’

SEISMIC SHIFT

Potentially a more existential issue for the sector is the risk that, in a world which is weaning itself off oil and where alternative energy sources are more competitive than they were, their reserves could come to be seen as ‘stranded assets’.

Other oil companies such as Chevron and Repsol have already started writing down the value of their reserves in line with the long-term price assumptions of the Paris Climate Accord.

Also, as more money floods into ethical funds and more managers come under pressure to shun the sector on environmental grounds, shares in big oil producers could become a smaller part of the market meaning they attract less money from passive and tracker funds.

There is a risk, says Mould, that this could become 'a self-perpetuating trend' as investors allocate less cash to the sector meaning its weight in the index falls making it less relevant.