Even the best-run companies sooner or later bang their heads up against cyclical ceilings and it's the turn of Oxford Instruments' (OXIG) boffins to bash their noggins. The scientific and research tools developer is feeling the pinch of research budget cuts in the west, particularly in the US where they insist on calling it 'sequestration', and particularly on its nanotechnology side.

Interestingly, average orders remain up year-on-year in Asia, but there's the whiff of a slump in the air across Europe and in America. The previously-laggard industrial unit continues to improve, which is a big plus, and the company insists it is still on track with its 14-cubed objectives (14% average revenue growth and return on sales, by 2014). Even so, it was enough for many investors to act with their feet as shares fall by more than 5% to £14.29.

But regular Shares readers will not have been caught short. We spelled out in May that the £816 million cap faced an orders squeeze, the evidence was clear, to us anyway. Oxford had admitted way back in November that visibility had shortened in its industrial segment and there was no hint to a change in the environment in April's update.

Cautionary statements have also come from similarly-placed capital kit suppliers, including Spectris (SXS) (read our story here), Sprient (SPT) (read out story here) and Renishaw (RSW) this year, raising the odds of order delays filtering through to Oxford, which also faces the winding down of its copper wire supply deal for the ITER plasma fusion reactor project.

The bigger worry now is that the company needs more than it can deliver to match previous market hopes, admitting 'the year is likely to be more second-half weighted than has been seen in recent periods.' Or not.

This is the type of statement that can spark profit warnings, so be warned. It looks like most analysts will look at top-slicing current year forecasts by 5% or 6%, in other words chipping a bit more than £2 million off previous £50.5 million pre-tax profit estimate.

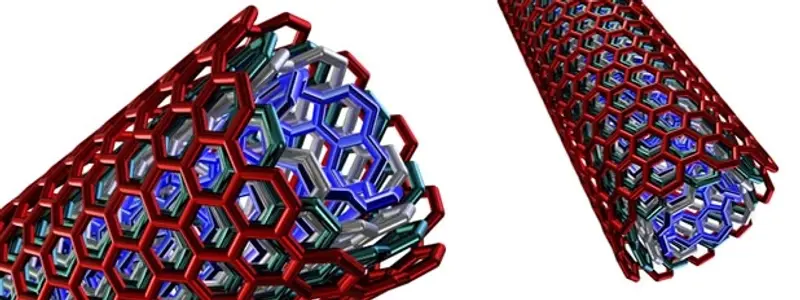

But let's add some perspective. As analysts at Numis point out, 'demand for Oxford's products is being driven by the shift to smaller applications and the ability to analyse and manipulate matter at the atomic level.' That means increasing nanotechnology research paid for with bigger and bigger budgets, in time. Numis estimates funding levels will increase between 10% and 20% a year going forward.

Oxford remains a fine company working in many of the most exciting parts of technology research (communications, healthcare, new energy, even gun shot residue analysis). Management is top drawer too, but they're not magicians, so don't expect cycle-bucking rabbits to be pulled from hats. None of this is a disaster in itself, it's just that we simply cannot rule out that a minor catastrophe isn't lurking round the corner, and investors hate uncertainty.