Diamond producer Petra Diamonds (PDL) has become the latest miner to fall foul of meddling by the Tanzanian government.

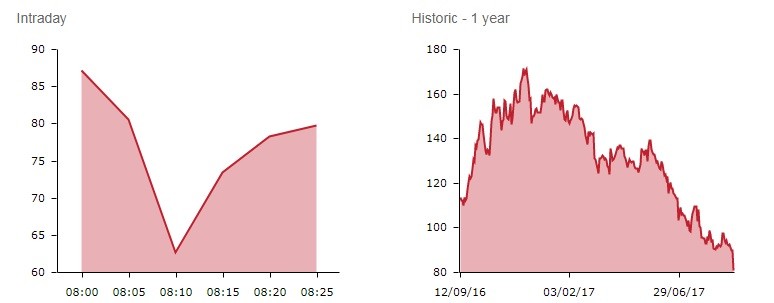

Its shares crashed 30% at the market open after saying the government had blocked the export of a parcel of diamonds and some of Petra’s employees were being questioned by the authorities. The share price decline had eased back to -7.6% by 8.40am to trade at 83.13p.

Petra owns 75% of the Williamson diamond mine in Tanzania and the government owns the other quarter. It has stopped mining at Williamson for ‘health and safety’ reasons and because of staff co-operating with the authorities.

The mine accounted for 12% of group revenue and 6% of group production in its 2017 financial year.

WHAT'S BEING SAID?

Reuters reported at the weekend that the government would launch an investigation into all officials involved in declaring the value of diamonds from the mine and issuing export permits.

The news report suggested the government had ‘nationalised’ the seized parcel of diamonds, claiming it to be worth $29m versus $14.798m reported by Williams Diamonds Ltd, a subsidiary of Petra.

In a statement published today (11 Sep), Petra said it was not responsible for the provisional valuation of diamond parcels from Williamson before they are exported to Antwerp. It said the work is carried out by the government’s diamonds and gemstones valuation agency.

‘This provisional valuation is used to calculate the company's provisional royalty payments to the Government, however adjustments to final royalty payments based on the actual sales proceeds for the diamonds, once sold in Antwerp, are then made at the end of the tender process,’ said the miner.

‘The competitive open tender process utilised by Petra is also used by several other diamond mining companies and has a proven track record of transparent price discovery.’

RESOURCE NATIONALISM TREND

Petra is the third company this year to suffer share price weakness as a result of interference by the Tanzanian government.

Gold producer Acacia Mining (ACA) has experienced significant share price damage as the government blocked the export of unprocessed ore and accused the miner of under-reporting the amount of metal in previous shipments.

Mining services group Capital Drilling (CAPD) has also suffered share price depreciation due to having exposure to the Tanzanian mining industry.

It flagged an uncertain outlook for earnings in the country in its recent half year results, although its two current production drilling contracts are currently unaffected.