Budget fashion chain Primark remains the jewel in the crown at Associated British Foods (ABF), having delivered ‘excellent profit growth’ in the half ended 2 March.

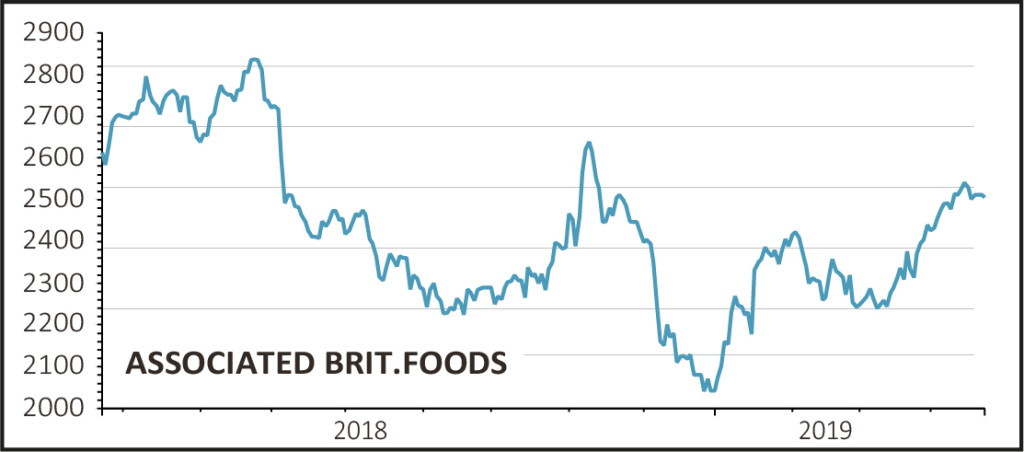

Shares in the foods-to-fashion conglomerate rise 1.6% to £25.46 on Primark’s positive showing and the improving earnings outlook for its sugar business, although the magnitude of today’s mark-up is constrained by disappointing developments at Allied Bakeries.

REITERATING GUIDANCE

Despite concerns over potential sugar industry-driven downgrades, half year results from the food brands behemoth behind Twinings Ovaltine, Ryvita and Patak’s are reassuringly in line with expectations.

Group adjusted operating profit softened 2% year-on-year to £639m, while guidance for the full year remains unchanged, management anticipating adjusted earnings per share (EPS) to be in line with last year’s 134.9p. Investors are also treated to a 3% hike in the half year dividend to 12.05p.

READ MORE ABOUT ASSOCIATED BRITISH FOODS HERE

Disappointingly however, ABF’s statutory pre-tax profit reduced by 15% to £515m in the half after a £65m non-cash write-down of its Allied Bakeries business, which has lost its biggest private label manufacturing contract with an unnamed major retailer. The effect of this volume loss will show up in the next financial year and the outlook for loss-making Allied Bakeries appears challenging due to low bread prices and hot competition.

PRIMARK POWERS AHEAD

As ever, it is discount clothing chain Primark that is driving the solid performance at ABF. Primark generated profit growth of 25% in the half, reflecting continued selling space expansion and improved margins, boosted by the effect of a weaker US dollar on purchases, although like-for-like sales were down 1.5% due to challenges in Germany and reduced footfall last November.

The good news is Primark is gaining substantial share in some competitive European retail markets and delivering growth in the UK, where like-for-like sales edged 0.6% higher and the chain continues to grab clothing, footwear and accessories market share.

Primark recently opened a new store in Birmingham, the largest outlet to date at an impressive 157,000 square feet, which has met with a positive reception from bargain-savvy shoppers.

Like-for-like sales in the Eurozone were down 3.2%, driven by a decline in Germany which masked strong growth in Spain, France, Italy and Belgium, while brisk business across the pond resulted in a much reduced US loss. For the full year however, ABF is guiding towards flat operating profits from Primark, as the recent strengthening of the US dollar weighs on second half operating margin.

SUGAR PROFITS TO SWEETEN?

ABF reports a slump in sales and profits at its AB Sugar business, the result of significantly lower prices which affected the EU sugar industry. But the encouraging news is that ‘with our ongoing cost reduction focus, a later phasing of profit in this financial year for Illovo, and some recovery in EU sugar prices we expect, from this period, our sugar profitability to improve.’

THE EXPERTS’ VIEW

Liberum Capital is sticking with its bullish view on ABF, a business offering investors ‘compelling exposure to secular growth trends in retail over the next 10 years. In our view, Primark remains well positioned to take market share and drive mid to high-digit sales growth in full year 2019-2023, backed by visible new space additions of 1 million square feet per annum primarily on the Continent and in the UK.’

And while EU sugar prices remain at historic lows, ‘ABF remains the most profitable and efficient EU sugar producer and is well positioned to emerge stronger from expected further consolidation in EU sugar production over the medium-term.’

Russ Mould, investment director at AJ Bell, comments: ‘ABF said Primark’s profits grew by 25% in its first half period, thanks to a greater amount of selling space and improved margins. That’s quite impressive considering that revenue only grew by 4.4%.

'Its challenge is to keep flexing its muscles by buying material at the best price, keeping tight stock management and avoiding discounts to protect margins.

'It can forward buy foreign currency but only for a short period so a strengthening US dollar will hurt operating margins in the second half of the year. But the one factor completely out of its control is the weather which can have a major influence on consumer appetite to go to the shops in the first place and the type of garments they want to buy.'