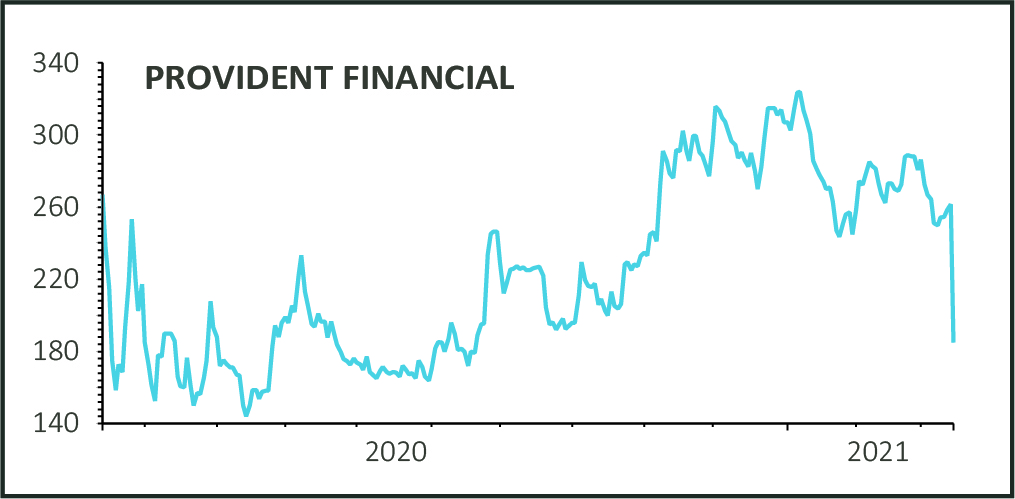

Shares in sub-prime lender Provident Financial (PFG) collapsed 29% to 186p after the firm revealed it may have to put its Customer Collected Credit Division (CCD) into administration due to the high level of customer complaints it had received.

The firm’s preferred solution is to pursue a Scheme of Arrangement ‘in relation to potential redress claims’ arising from customer credit-worthiness complaints based on lending at CCD before 17 December last year.

It has set aside £50 million for customer redress and £15 million to cover operating expenses. However, if a Scheme of Arrangement isn’t approved the business ‘will be placed into administration or liquidated’.

COMPLAINTS SOAR

The CCD business was already under review both by Provident Financial itself and the Financial Conduct Authority due to a sudden rise in claims in the second half of 2020.

The number of complaints to the Financial Ombudsman Service across the home credit market roughly trebled from the first half to the second half. Provident Financial had to repay customers £25 million in the second half compared with £2.5 million in the same period a year earlier.

The group said it would process all outstanding relevant claims under the Scheme of Arrangement, ‘although redress payments ultimately determined may be significantly less than the amount claimed’.

SLIM CHANCE

Given the Scheme is subject to the approval of the majority of customers with redress claims, and the sanction of the Court, it is hard to see it being implemented.

Moreover, the FCA has made it clear it will not support the Scheme ‘for a number of reasons including, in this specific case, because redress creditors will receive less than the full value of their claims’.

Separately, the FCA has opened an investigation into the affordability and sustainability of CCD’s lending to customers with the first hearing due next month, ahead of the publication of Provident Financial’s full year results.

Numis analyst James Hamilton describes the cost of customer redress as ‘affordable’ and remains bullish on the stock based on ‘the substantial recovery prospects’ for Vanquis and Moneybarn which are ‘more meaningful for investors’.

READ MORE ABOUT PROVIDENT FINANCIAL HERE