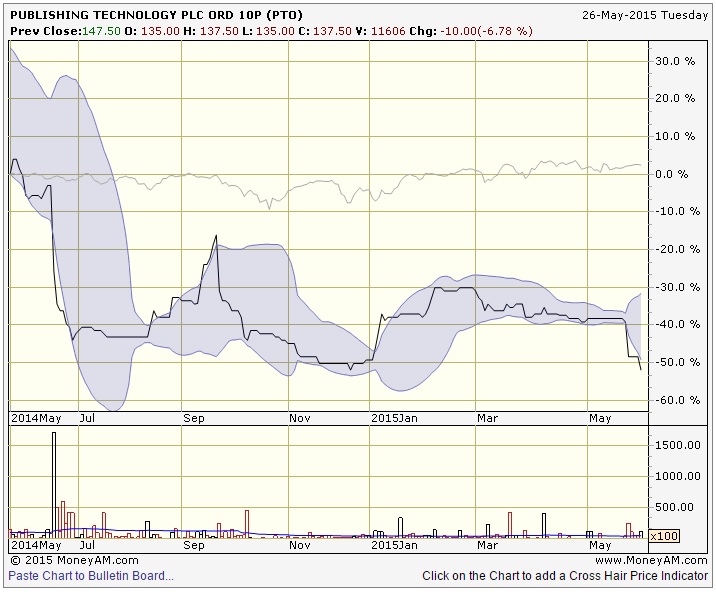

In an age of click-throughs and digital eyeballs it is perhaps a little ironic that Publishing Technology (PTO:AIM) appears to have itself lost the plot. Make no mistake, these are ugly full year 2014 figures from the Oxford-based technology and software supplier. Claims of being the market leader, working with over 400 clients, including over 70% of the world’s largest book and journal publishers (McGraw Hill, Hachette, Harpercollins, Bloomsbury (BMY), Penguin, Reed Elsevier (REL) among them) sounds a bit hollow today.

Pre-tax losses of £4 million on £14.4 million revenues means a revenue slump of 15% on 2013 when it posted a £700,000 pre-tax profit. This is not a shock though, as Shares extensive analysis of the business and its challenges revealed back in October last year. A major contract delay was just the start, a new CEO, Michael Cairns, installed in April 2014 and subsequent business review has revealed all sorts of fundamental problems, from skills shortages to poor project management. Yet the key problem has been Publishing Technology's propensity to over-promise on projects.

With new products and tools requiring more investment, the company finds itself strapped for cash, hence today's cash call and near-7% share price slide to 137.5p. Looking for £10 million of new funding at 120p, that's a 19% discount to Friday's 147.5p close.

Publishing Technology’s revenues are generated mainly from its Advance, Vista and Online (Pub2Web) products, which supply content systems, audience development and content delivery systems respectively.

Yet there's a silver-lining here. The company has largely dug its own hole with a certain amount of its own ineptitude yet none of its operating issues look particularly complex, which should mean they're not difficult to fix. It's far too early to judge Cairns' strategic rethink, but there is at least hope for investors.