Consultancy giant PwC has revealed plans to recruit over 1,000 technology specialists between now and 2020 as it delves ever deeper into the wide-ranging market for all things digital security. We're talking about effective threat vulnerability management, predictive analytics or intelligence and IT risk and resilience strategies.

This is far from the first shot fired in the cyber security industry expansion but it does illustrates (again!) that getting the right skills will not be easy. There are only so many experts around making this a real staffing race.

Graduates will play their part in refilling the talent pool - PwC's own plans include a 200-strong grad drive to join its newly created and dedicated three-year programme - but the demand for the right people is soaring and it won't get any easier to recruit as we move forward.

Back in April will flagged this as a very real issue, alongside news of the AIM IPO of little specialist Osirium Technologies (OSI:AIM), a small but ambitious company hoping to hit the fast lane of growth.

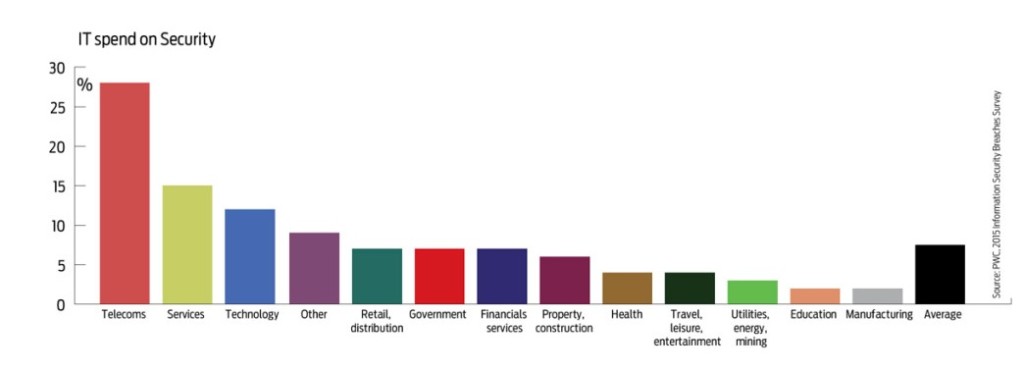

But bigger fish, like PwC and BT (BT.A) are also swimming in this pond. As we have previously revealed, telecom firms have so far led the way when it comes to investment in cyber security, and we noted with interest BT's plans to bolster its own digital security army substantially over the coming 12-months.

'BT is boosting its security business, embarking on a hunt for 900 new security recruits over the next 12 months, as it looks to strengthen its position in the fast growing cyber security market further,' explained TechMarketViews analyst Tola Sargeant at the time.

This creates another challenge for investors as they survey their options, the main UK stock market-listed ones we have highlighted below.

On AIM

Corero Network Secuurity (CNS:AIM)

GB Group (GBG:AIM)

Intercede (IGP:AIM)

Main market

NCC (NCC)

Sophos (SOPH)

A few others (doing a bit of cyber sec)

Micro Focus (MCRO)

Iomart (IOM:AIM)

SQS (SQS:AIM)

Eckoh (ECK:AIM)

(Not a complete list by any means)

'Cyber itself is an early stage market, so growth is the key right now. And there are many new providers targeting specific emerging areas,' says John O'Brien, also an analyst at TechMarketViews.

At the risk of repeating ourselves, here's how we summed up in April, and we haven't changed ours minds.

'Demand for skills is already high and will only intensify. That would appear to favour the bigger players, with more established brands and market presence, and, presumably, greater creative opportunities within for programmers and their ilk. But maybe not, because IT experts are often fairly anti-corporate, they usually want to retain their own sense of individuality that can be lost working for large organisations, so let's hope that access to skills will not thwart what could be a thriving growth and profits niche for smaller companies in the coming years.'