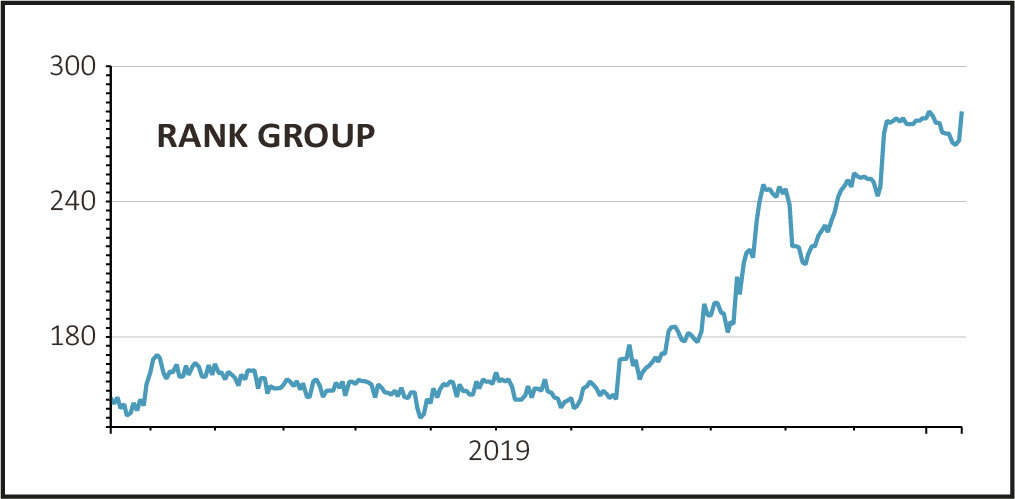

Shares in casino operator Rank Group (RNK) were in demand today after the company upgraded its full-year operating profit guidance to £105m to £115m, around 12% higher than current consensus. The shares spun 5% higher to 280p.

The upgrade was prompted by positive trading from the Digital business, the Grosvenor and international venues as well as ongoing cost savings related to Rank’s Transformation Programme.

Broker shore Capital reckons that the upgrade implies like-for-like revenue growth of 10% compared with the 6% for the full-year that it had penciled-in. In response the broker has increased its pre-tax profit by 11% to £106m and its earnings per share estimate by 10% to 22p per share, roughly in the middle of the new guidance range.

Shore Capital estimates that every percentage point of like-for-like revenues growth is equivalent to around an extra £4m of extra profit; therefore it anticipates some further scope for future upgrades.

While most of the upgrade is the result of positive trading at the Grosvenor venue estate the Digital business seems to be seeing robust trading following the recent acquisition of Stride Gaming.