If getting a decent return on your investments was tough in 2015, the year ahead isn't looking any easier. '2016 looks to be a challenging year for investors, with different countries and asset classes at such different stages of the investment cycle,' states Standard Life Investments, the global investment manager.

As we at Shares continually impress on readers, out of adversity come opportunities, but you must arm yourselves with the right information. This view is echoed by Andrew Milligan, head of global strategy at Standard Life Investments and he's been peering across the investment spectrum and looking at how investors might best benefit from the various asset classes.

Andrew Milligan, head of global strategy at Standard Life Investments

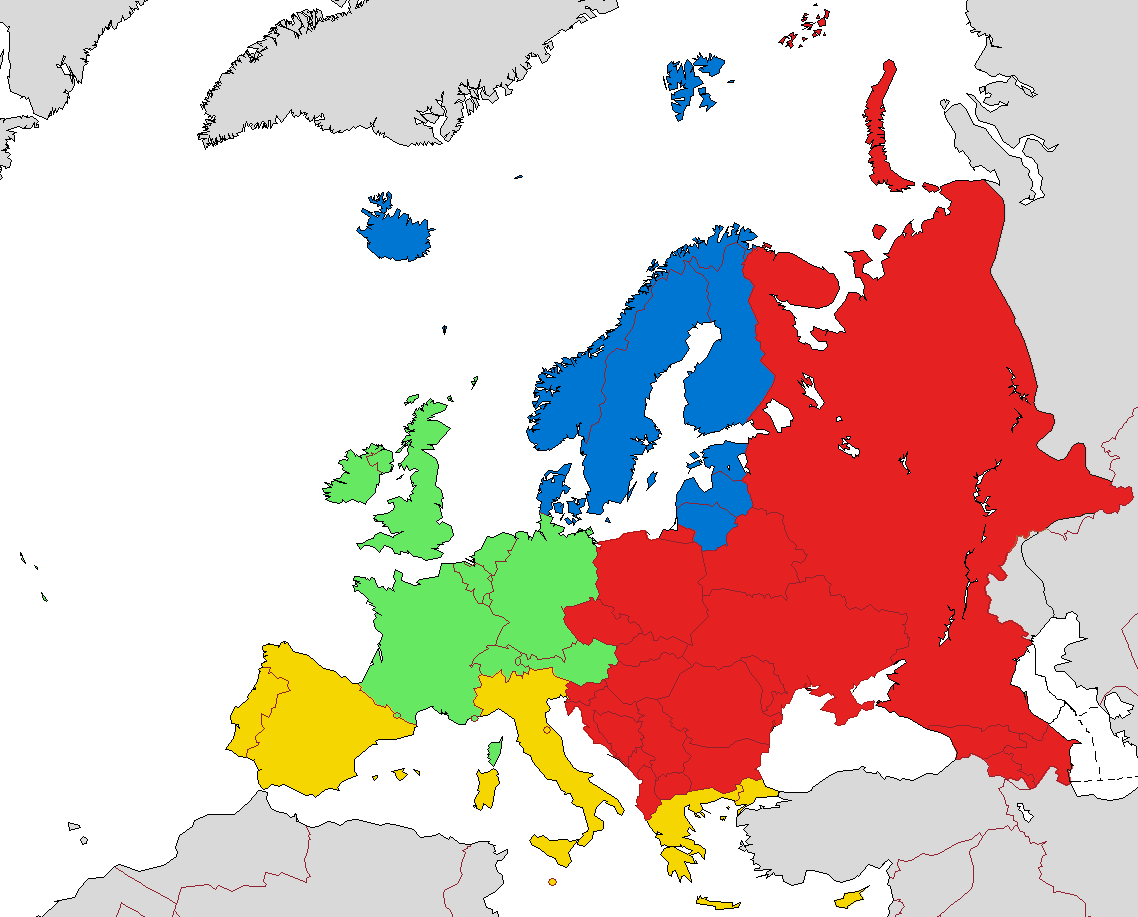

'We encourage a highly selective, relative value approach, preferring developed to emerging market assets, and a preference for Europe or Japan, which will both benefit from lower commodity prices and an improving economy,' he says. 'We are also moving higher up the capital structure into corporate bonds as company profits come under pressure globally. Conversely, we are short duration in government bonds, and underweight in stock markets which are relatively expensive or too exposed to commodity pressures, such as the US or developed Asia.'

Milligan goes on to explain Standard Life's tactics through 2015, a year that saw the investment management firm steadily switch to lower risk in multi-asset portfolios, to the lowest levels since 2012 no less. 'This reflects concerns about valuations, about the slowdown in corporate earnings growth, and an upturn in financial market stress. Into 2016, key triggers to raise or lower risk exposure in portfolios will include the direction and extent of the dollar?s move, the success of China?s policy stimulus, and the impact of Federal Reserve policy tightening on highly indebted emerging market countries,' Milligan spells out.

Looking at some of the key themes and asset classes to consider, Milligan has some wise words for private investors, so let's tale a whistle-stop tour, detailed below:

On portfolios

'Investment decisions are becoming more complex as growth paths and monetary policy settings diverge. The ?two-speed? economy will be a key investment theme in 2016, with cheaper commodity and energy prices driving stronger household consumption and business services, contrasting with weaker industrial production and global trade.'

On volatility

'The list of potential drivers of market turbulence is large. In particular, we expect US monetary policy, Chinese growth concerns, and politics, including the US Presidential election and a possible UK EU referendum, to drive market volatility.

Democrat hopeful, Hilary Clinton

The success of Chinese policy-making will have a major impact on developed and emerging markets asset prices. In 2016 the big question is how effective the Chinese government will be in stabilising and rebalancing that economy. With the US at a later stage of the investment cycle, we are seeing modestly negative S&P 500 profits growth. A further concern is the deterioration in US company balance sheets in the past two years, with sluggish earnings and rising net debt, against the backdrop of Fed tightening.'

On emerging markets

'The deceleration in emerging market economies has been led by the slowdown in China and recessions in Brazil and Russia, alongside the impact of low oil prices on many oil exporters. We see this as a mid-cycle pause. Emerging markets policy responses should stabilise the situation; however a more stable dollar would support global commodity prices and may encourage global investors to buy into emerging markets assets again.'

On equities

'In recent years a pro-equity stance has been the correct strategy, but 2015 was different. Global equity returns are broadly flat year to date within a 15% range during the year. We expect 2016 to see more of the same: modest total returns accompanied by sharp market cycles. We favour European equities, reflecting more favourable prospects for European earnings as top line sales recover while costs are contained.'

On fixed income

'Duration in our portfolios is short, due to concern about the upside pressures on yields reflecting Fed tightening, the increase in headline inflation in 2016 and a pull back from safe haven flows. Our Light positions in US Treasuries, UK gilts and Japanese government bonds are offset by a Heavy position in European debt, supported by weak Eurozone inflation and ECB policy. We also prefer to move up the capital structure, holding more investment grade corporate bonds - default risk is rising but investment grade valuations are attractive as long as no recession appears.'

And finally, on economics

'This remains a world of low numbers, in terms of growth, inflation, bond and dividend yields, and interest rates. We expect to see global real GDP growth to pick up from about 3% in 2015 towards 3.25% in 2016. The US continues to grow 2% to 3% per annum (pa), we expect a soft landing in China (GDP of some 6% pa) and growth in Europe moving towards 1% to 2% pa. The good news is that there are signs of global economic strength in many key areas and countries. 2016 will see more supportive fiscal policy.'

'The outlook is still positive for profits in Europe and Japan; cheaper commodity and energy prices are supporting household incomes and business margins, and the labour market is improving steadily in most of the larger economies,' Milligan concludes.