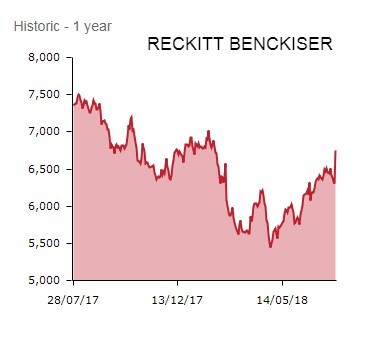

Nurofen, Strepsils and Cillit Bang brands owner Reckitt Benckiser (RB.) raises full year sales growth guidance following a strong second quarter showing. The improved outlook helped the consumer health and hygiene giant’s shares rally 6.8% to £67.42 on Friday, topping the FTSE 100 leader board.

A better-than-expected performance from its infant formula business, combined with a sturdy showing from the core business, lie behind upgraded 2018 guidance. In fact, the long-standing Shares favourite increases its full year net revenue target from 13-14% to a 14%-15% growth range, one implying annual like-for-like sales growth ‘at the upper end of +2-3%’.

COMEBACK KID

Results for the half to June confirm Reckitt Benckiser is on the comeback trail following a tough period for consumer goods giants generally, Reckitt also stung by a damaging cyber-attack last summer.

Second quarter like-for-like growth of 4% is ahead of the 2.9% called for by consensus, driven by strong growth in both the Health and Hygiene Home divisions and with Reckitt lapping a soft cyber-attack disrupted comparative quarter. Long-coveted by investors for its robust cash flows, underpinned by a winning brand portfolio, Reckitt also declares a 6% hike in the half year dividend to 70.5p.

WINNING FORMULA

Total growth for the second quarter was 23%, boosted by core business sales and pricing gains and June 2017’s transformational acquisition Mead Johnson Nutrition, the US baby formula maker now badged as the IFCN business, which has taken Reckitt into the vast Chinese infant formula market.

‘IFCN is currently experiencing strong category growth above our medium-term expectations, led by China, the world’s largest IFCN market,’ says Reckitt Benckiser. ‘Within our IFCN business, we continue to make progress in accelerating innovation, improving in-market execution and developing new channels.’

During the half, the IFCN business benefited from the launch of its new Enfamil NeuroPro range in the US as well as expanded distribution in Mom and Baby stores in China.

Elsewhere within Health, Reckitt enjoyed growth across the majority of its brands, although laggards included Scholl, whose sales were weak, as well as Mucinex, the latter brand hit by the re-entry into the market of private label competition.

Within Hygiene Home, strong growth in North America compensated for a muted growth showing in Europe, while Powerbrands including Finish, Lysol, Air Wick and Harpic led the growth charge.

CEO Rakesh Kapoor comments: ‘Delivering growth and the successful integration of MJN remain our key priorities. Q2 was a quarter of progress against both of these priorities. MJN integration is well on track, with IFCN performance exceeding expectations and synergies being delivered. RB 2.0 is driving greater focus and energy as we operate under our new business units - Health and Hygiene Home. I am confident that as we fully realise the benefits of RB 2.0, we will deliver outperformance in both business units.’

Liberum Capital, reiterating its £74 price target and ‘buy’ rating, argues ‘Reckitt’s strategic focus on faster growing, higher margin Health and Hygiene categories should lead to acceleration in organic sales growth to 4% in the medium-term.’

Furthermore, the brokerage says: ‘The group’s reorganization in two discrete divisions - Health and Hygiene Home - creates long-term optionality for the group and could potentially lead to a break-up of the group, particularly if a large consumer health acquisition materialises.'