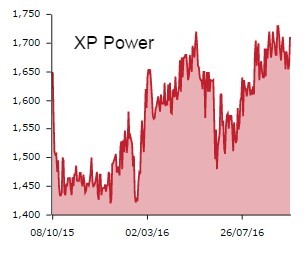

Investors are drawn to power switching components supplier XP Power (XPP) as record orders flood in during the third quarter. New business levels beat the previous record of £31.3m, chalked up in the second quarter of the current year, hitting £34.2m in the three months to 30 September.

That comes as a relief for investors against a fairly soggy macro growth for much of 2016, as Shares explained in detail in September. Which explains today's 4%-plus rise in the share price to £17.30, the highest the stock has been since January 2014.

Revenue in the nine months to 30 September jumped from £81.7m to £92.6m and management fully expects full-year trading to meet expectations. Current forecasts for 2016 come in at £27.4m of pre-tax profit on £127.2m revenues.

Apparently some of the third quarter boost stems from orders pencilled in for the final three months being pulled forward, so the company's optimism going forward will put minds at ease.

XP is also upbeat about its North American markets returning to growth.

Edison is optimistic about XP’s outlook as the firm will benefit from recent investment in engineering and sales resources, as well as acquisitions in the US and North Korea.

The broker says its strong forecast cash generation will enable XP to invest in further growth via internal product development or bolt-on acquisitions.

The firm has cut debt significantly from £6m at the end of June to £2.2m to date.