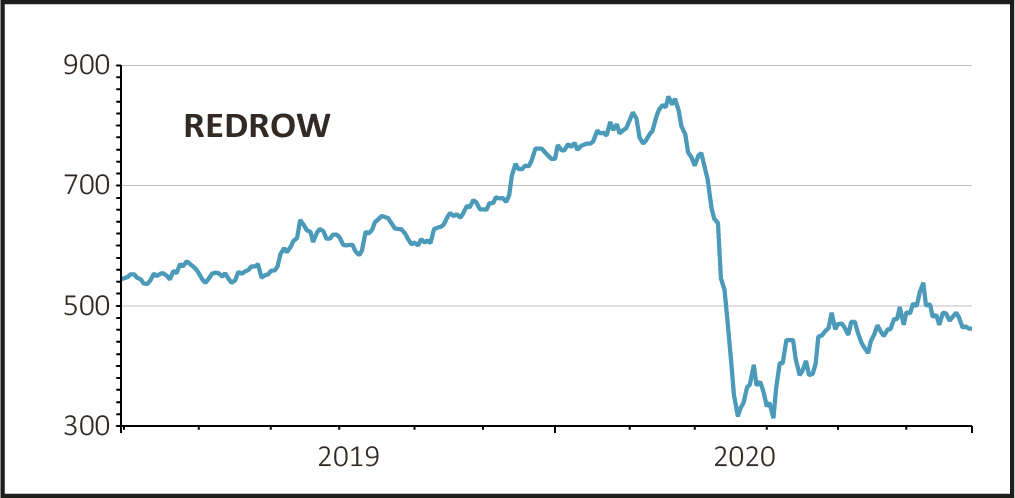

Shares in Deeside-based housebuilder Redrow (RDW) shed 5% to 441p on higher than average volume in early trading after the firm warned that profits for the year to 28 June would be ‘substantially’ below last year.

As well as the obvious impact of the pandemic on sales and completions, the builder is scaling back its London operations and focusing on its higher-margin regional businesses and Heritage homes.

While this is positive for shareholders in the long term as it means higher profits, in the short term it means writing down the value of some of its London assets, hence the additional hit to 2020 earnings.

SALES PICKING UP

With just over 4,000 homes completed in the year to the end of June, compared with over 6,400 homes completed the previous year, turnover is expected to be £1.34bn against £2.11bn, a drop of 36%.

Due to the shutdown of sites and the impact this had on completions, the value of the firm’s order book was significantly higher at the end of June at £1.4bn, with 70% of revenues already contracted.

However, in the five weeks since its sales offices reopened demand has been healthy, with the ratio of net sales per outlet per week hitting 0.56 compared with 0.59 a year ago supported by the government’s Help to Buy scheme.

CHANGE IN STRATEGY

Meanwhile Redrow has noticed a distinct shift in attitudes by buyers since the pandemic, with more people wanting to live closer to green spaces, away from city centres, with more outside space and ideally a dedicated home workspace.

Therefore it is pulling back from building apartments in London, with the exception of the Colindale Gardens development, and is concentrating its future growth on its regional businesses as well as its more period-looking Heritage range.

As executive chairman John Tutte put it, while the crisis has been testing for the business, it has ‘provided us with an opportunity to focus on our core strengths putting product, customer satisfaction and the environment at the heart of a recovery strategy to maximise shareholder returns.’

The company will give more detail on its new strategy when it presents the full year results in September.