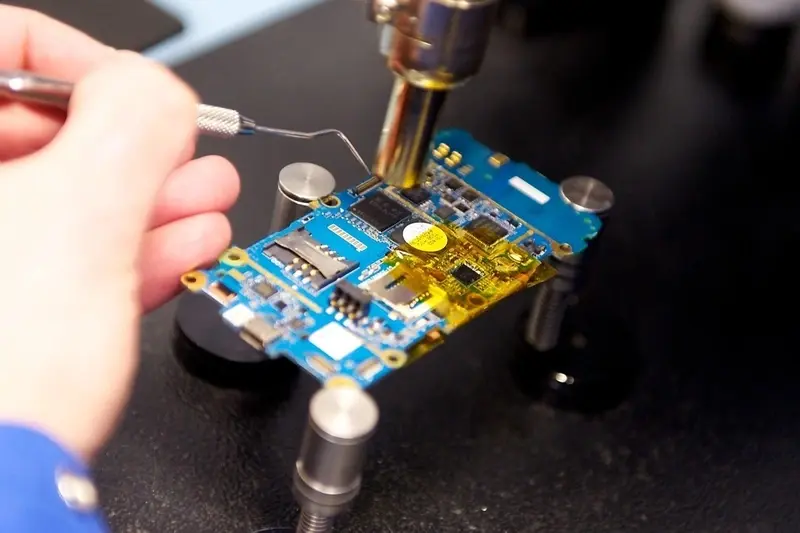

Investors in Regenersis (RGS:AIM), a specialist in electronics recycling and data erasure, might wish they could delete the last 12 months.

Shares are this morning trading 19.8% lower at 162p on its second majortrading disappointment in the last year.

The London-based, Europe-focused outsourcer has lost a key customer contract which will impact profitability in its next financial year, ending 30 June 2016.

Shares in the stock traded above 330p before a 23 September 2014 final results announcement which, despite an upbeat outlook statement, caused a 28% slump.

Currencies are expected to be another headwind in the year ahead. Regenersis' European expansion has led to increasing exposure to the euro and Poland’s zloty. Continued weakness in both currencies is likely to continue to impact results into the next financial year.

Despite these issues, management is still guiding towards increased profitability in 2015/16.

Investors backing a change in fortunes at the business will point to encouraging performance in Finland-based Blancco, a data erasure business bought in 2014.

Sales grew 27% in its first full year as part of the group, driving operating profit in the unit, after adjusting for currency differences, 45% higher.

Regenersis’ trading update says results for the 12 months ending 30 June 2015 will be reported on 22 September.

Management expect the numbers to be in line with expectations, which means adjusted earnings before interest and tax (EBIT) between £15.4 million and £15.8 million.

CORRECTION: A previous version of this article said Blancco is based in Spain. It is based in Finland.