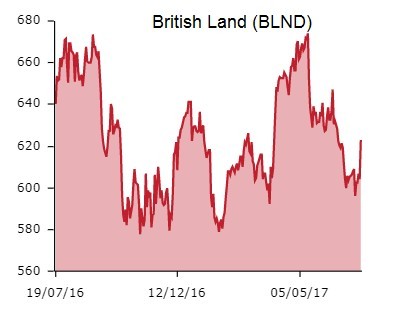

Real estate investment trust British Land (BLND) tops the FTSE 100 leaderboard, up 3% to 622p, as it announces a £300m share buyback programme alongside a solid trading update.

The company says strong demand means the opportunity to acquire new assets at attractive returns is ‘more limited than usual’ and says buying its own shares is a ‘clear value opportunity’ given a substantial discount to net asset value (NAV) and a 5% dividend yield.

Industry standard NAV at 31 March was 915p per share, implying a 32% discount even after today's share price rise.

We have written before on the merits of buybacks versus other forms of returning cash to shareholders such as special and ordinary dividends.

CORRECTION FEARS

British Land trades at a discount due to fears of a correction in the UK retail and office properties which dominate its portfolio. Today’s update confirms steady conditions and continuing support for prices from significant levels of international capital.

Jefferies analyst Mike Prew has an ‘underperform’ rating on the stock and a 500p price target. In a note entitled ‘Let Them Have All The Stock They Want’ he says:

‘We would sell all the stock we could into this liquidity window.’

He notes it is a decade since a planned share buyback at British Land before the full onset of the financial crisis.

‘It’s the 10th anniversary of CEO Stephen 'the equity market's too gloomy' Hester's £500m share buyback at a pre rights price of £14, which was quickly pulled. 2017 looks like a rerun of 2007 and CEO Chris Grigg's gamble of running more leverage risk anticipating an extended real estate cycle is faltering as global bond yields rise.’