All-in-all today's full year figures from design and engineering software supplier AVEVA (AVV) are pretty decent. Organic revenues are up 10% to £237.3 million, once you strip out currency fluctuations, slightly beating consensus expectations of £236.9 million, while pre-tax profits of £78.3 million outperformed the market's £76 million estimates. Investors are clearly relieved, pushing the shares close on 11% higher to £23.94. The stock was trading at £18.95 just a month ago.

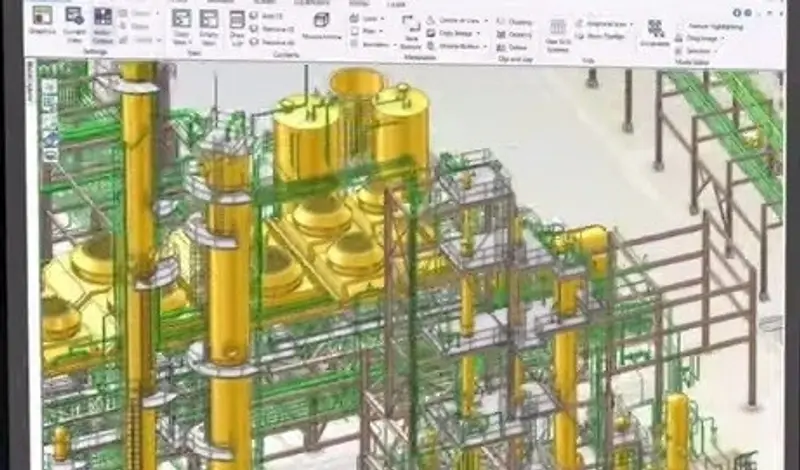

AVEVA provides engineering, design and enterprise software solutions to primarily the oil and gas, marine and power industries. But today's results do demonstrate something of a two-speed business at present - robust engineering and design systems (EDS), a more flaky showing from enterprise solutions.

'The outlook is for high single-digit EDS sales growth versus our 8% forecast,' says Investec's JulianYates today. 'Enterprise Solutions disappointed with sales of £25.5 million versus our £29.5 million and while the company is looking for breakeven in full year 2015, this will impact forecasts.'

Analysts at investment bank Goldman Sachs sticks to its Buy recommendation flagging AVEVA's strong market positioning. 'Full year 2014 results underscore AVEVA's strong competitive positioning as it continues to generate growth ahead of peers despite weakness in end-markets, and it remains a premier strategic asset in the space.'

David Toms of Numis Securities agrees, saying 'we think the most notable element of these results is that AVEVA is outperforming its largest competitor,' (US firm Intergraph), 'which we think grew 6% to 7% in the six months to March 2014 versus AVEVA's 11%, and also holding its growth rate in a market widely expected to be more challenging.'

Those challenges could come in the oil industry. While Petrofac's (PFC) recent trails don't appear to have hurt AVEVA there is widespread belief that many of the world's biggest oil companies are tapering their project investment, which we highlighted in Shares last month. The company admits as much saying, 'our EPC (Engineering, Procurement and Construction) customers are seeing the effects of lower capital expenditure growth amongst the Super Majors,' before counter-balancing with 'although in offshore, where we are traditionally strong, investment has continued to grow.'