Investors in UK engineering firms have enjoyed a highly positive spell over the last 12 months or so and FTSE 250 Rotork (ROR) is the latest to leave shareholders in chipper mood.

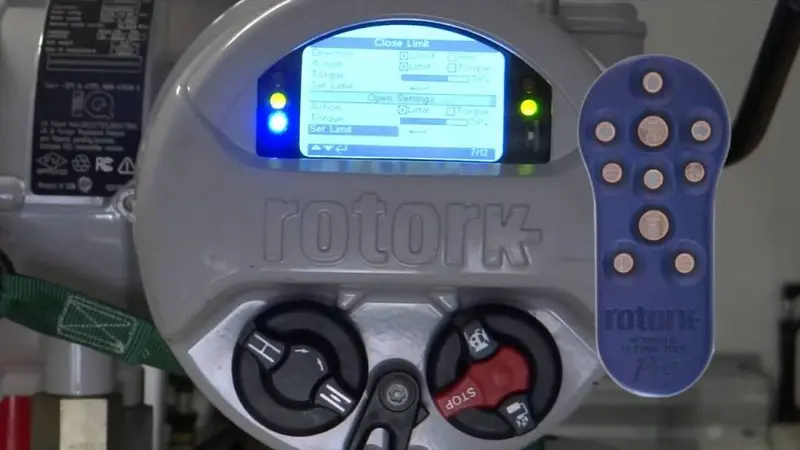

The £2.82bn company, which makes actuators and flow controls, told investors on Monday that it expects full year revenue to grow by mid-to-high single digits this year to 31 December 2018, with profits margins showing improvement too.

That news has sparked a near 10% jump in the share price to 328.1p.

Operating profit margins last year were 14.8%, a good deal lower than the 20%-plus of previous years, so improvement here this year is very welcome.

GROWTH BACK ON THE MENU

That promises the first real growth in pre-tax profits this year since 2014, and that’s in spite of ongoing currency headwinds.

A strong start to 2018 is behind the company’s optimism, where industrial applications and oil and gas industry demand have been particularly firm.

The energy industry is worth watching given the renewed strength of oil prices. Brent crude, for example, has been in a strong uptrend since last June with prices increasing by close on 70% to the current $74 per barrel level.

OIL POWERING CURRENT RECOVERY

The effect is that drilling investment projects in the sector have become commercially viable again, giving a lift to industry services firm, such as Rotork.

Rotork is not alone in benefitting. UK engineering group Smiths (SMIN) recently revealed good demand and strong order books at its John Crane oil industry arm. Mission critical kit supplier Weir (WEIR) has gone even further, raising £363m to fuel a large acquisition that largely makes energy markets and mining its core focus.

‘Engineer Rotork is on the way to recovering its reputation as a high-quality engineer after a period in which it was held back by the weak performance of its oil and gas related business,’ says Russ Mould today, investment director at investing platform AJ Bell.

‘The company, which manufactures industrial flow control equipment, has recovered the premium equity rating it enjoyed before the oil price crash in 2014 with its shares hitting an all-time high as it posts a 10.2% increase in first quarter revenue. Higher demand from oil and gas producers helps underpin this rise as the firm also reveals order intake up 20.9%.’

But investors be warned. Oil prices can be volatile and the energy industry cyclical. Those with heavy exposure may look very clever as they cash-in during the good times, but when the cycle turns, as it inevitably must, downside risk to share prices could be considerable.